Right in the city centre!

My life basically began in the city. Bukit Bintang to be exact! I was born and brought up in a well-to-do family and had the kind of childhood that everyone would yearn for.

I was the youngest child in the family and was raised with four siblings. Even though my dad was the only breadwinner for the family, our life was still good. Well of course, he was the managing director of a renowned firm. A well-deserved position for his many years of hard work and sweat.

My parents were quite traditional. They taught me the importance of learning, they wanted me to study well. But honestly, education was not my strongest point. I struggled, but I did not give up at the same time.

I was always a very ambitious girl since I was a child. I had always dreamed of achieving something in my life. After leaving Bukit Bintang Girls’ School, I enrolled in Monash University to study Bachelor of Science.

I understood life

Life was treating me well until one day, my dad broke me the news, “Kit, I’m retiring”.

I can still recall his tone of voice and the worries I saw in his eyes as he stared at me. I understood his concern as he was the only breadwinner of the family. Things turned out to be slightly difficult afterwards, but survival was not an issue.

I was the only person to remain with my parents at that time. My siblings were married and had their own family to take care of. And I was still studying in college.

During my childhood, I always looked up to my dad and wanted to be just like him. He was a good and good man with a reputable job. But then I realized this is not what I wanted in life.

My dad had a typical 9 to 5 job. For many years I saw him returning home late and exhausted, which caused his health to decline. Then one day, he was asked to leave as though he meant nothing to the company.

This got me thinking. Should I sail in the same boat? Or should I follow my guts and jump? I was unable to answer these questions right away.

After completing my bachelor’s degree, I started working temporarily. Further down the road, I enrolled in Segi College to study Master in Business Administration and graduated.

The Game Changer

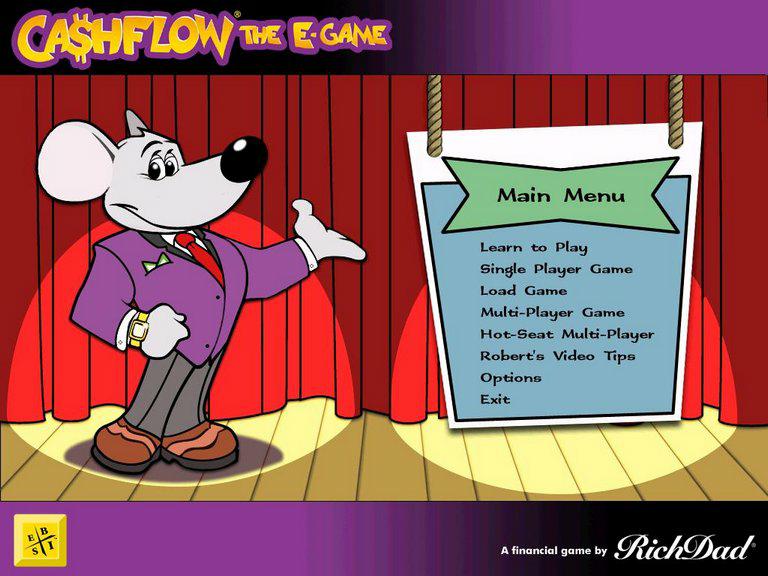

When I was in college, there was one thing which triggered me to become a property investor, which cultivated the interest in me. It was none other than a computer game called Cashflow 101! A game introduced by the property legend, Robert Kiyosaki.

For those who are not familiar, this game is all about investment and making the most out of everything! The game has two stages – the rat race and the fast track.

In the first stage, the player has to set a character and a financial situation. The aim is to increase your passive income until it exceeds the character’s expenses. In stage 2, the player has to invest or accumulate $50,000 monthly cash flow while avoiding lawsuits, divorce or tax audits. The player has to fill up a financial statement and log each deal.

The motive of the game is to illustrate that assets generate income and liabilities incur expenses.

To be honest, I was addicted to this game. I spent hours playing it, which eventually improved my investing skills. Following this, I became a huge fan of Robert Kiyosaki and started reading his books. He became my inspiration!

Taking the first step

Meantime, I also started investing in the stock market. After almost a year, I gained zero profit, which discouraged me to continue further. Hence, my stock market journey ended there.

Then one day when I was driving around with my mom in Bangsar she said, “Do you know that these houses used to be very cheap those days? About RM20,000 only!”

I was shocked and told her that it now costs above a million. On that very day, I decided to invest in real estate.

I was 25 when I decided to invest in my first property. I bought a small unit in Cyberjaya, with 8 years GRR (guaranteed rental return) scheme. Of course I was unable to fork out the deposit on my own at this age. But I’m glad my parents came to my rescue. I was also lucky enough to acquire the Developer Interest Bearing Scheme (DIBS) at that time.

After a while, my friend and I started a business together. Unfortunately, I was deceived and lost everything that I’d invested. I paid the price for trusting the wrong person.

I managed to survive with my 9 to 5 job as a medical representative. Life was normal and three years passed. And I know I have been going in the wrong direction without proper guidance. But the question still remained in my mind: Should I sail on the same boat? Or should I follow my guts and jump?

Jumping off the boat

I was 28 years old when I attended a property gala dinner. Little did I know that very day would change the course of my life forever.

I met Gary Chua, the CEO of SmartFinancing, a firm which brings property investors together.

It was an honour, I would say. To be able to get advice and suggestions from him; to be guided in the correct path. I was amongst the pioneers to join SmartFinancing community.

Even though I’d invested in my first property prior to joining SmartFinancing, yet it did not go as I planned. My first property had an 8-year GRR scheme with a stagnant capital appreciation. I also didn’t have the confidence to invest for the next three years.

Learning from Gary was one of the most crucial times of my life. At the same time, I also attended many property talks to increase my knowledge. With the motivation I got from Gary, I got over my fears and continued my journey in property studies and investment.

Not long after that, I finally get to the answer the question that was stuck in my mind for all those years. I decided to jump off the boat!

A step closer to achieve financial freedom

It was a big relief when I finally quit my job! But my parents did not support my decision wholeheartedly.

However, deep down in my heart, I knew that it was the right thing to do. I was thrilled!

First, I acquired a serviced apartment located in Iskandar Malaysia dubbed EcoNest. The unit was quite small, roughly about 700 sq ft and cost about RM500,000 back then. Since I was a student before, I am well aware that parents will always have your back no matter how hard life is. Hence, I decided to make it a student rental property.

When I invested here, the show gallery was not even available. It was that new! But I put my faith on the gem of a location opposite EduCity, an education hub.

This is an ongoing project and its value has appreciated slightly. And I strongly believe that the price will further appreciate once the project is completed is ready to be tenanted by students.

Setia Ecohill and Eco Majestic in Semenyih are also among the first properties I acquired. Even though many discouraged me by saying that I am making a wrong move, yet I followed my instincts and went for it.

I was among the pioneers to acquire the properties there, where its prices were much cheaper as compared to now. I can safely say that its values have appreciated immensely over time.

It’s funny that the people who told me Semenyih will not prosper ended up looking for a home in Semenyih itself.

In the end, I started to make a living out of my real estate investments.

A decision that I’ll never regret

My investment spree continued and I obtained many properties as the years passed. I purchased several properties in Johor, but Kuala Lumpur and Klang Valley remained as my favourite spots for investment. I didn’t explore the opportunities outside of these areas as I have a very low appetite for risk. I prefer making risk-free decisions.

Now, I own over ten properties and co-own several other properties. I’m a step closer to achieve financial freedom and have never looked for another job again. I still attend property talks to increase my property knowledge and give talks to inspire people to follow their dreams.

As for me, I am glad and will never regret the decision that I have made. I started with a very small amount of cash and with proper guidance, I have managed to get to the position I am today.

Whatever happened is nothing but a beginning to me. It is necessary for me to thank Gary at a time like this as it’s not every day you run into someone who changes your entire life.

Mangalesri Chandrasekaran, Editor at PropertyGuru, edited this story. To contact her about this or other stories email mangales@propertyguru.com.my