Getting into the real estate game has always been the tried-and-tested way to go if you’re looking to grow your wealth.

It’s one of the few assets that will appreciate during the boom times, and safely maintain its value (or at the very least, only have a slight decrease) during an economic downturn.

While there are no secret tricks or special formulas for you to follow when it comes to choosing a good property that will be profitable, it’s actually a lot of applying good common sense.

We’ve put together a list of golden rules that apply the fundamentals of ‘Propenomy’ for you to refer to.

Hopefully, you’ll come away with the basic (but indispensable!) knowledge of finding the most affordable home that fits your budget, while having the greatest room for capital appreciation.

PropertyGuru Tip

Propenomy is a combination of the words ‘property’ and ‘economy’, a model that was developed by Dr Daniele Gambero. It’s purportedly able to help you read the future demand for both residential and commercial properties, based on the planned economic growth in a selected area.

Rule #1: Perception Vs Reality

Buying a home is one of the most important financial decisions that a person will make in his/her life.

Making one based on just perception alone is not advisable, not all that glitters is gold; it’s wiser to conduct due diligence on a few properties and the surroundings before putting down any money.

There must always be a good demand driver that will help the future appreciation of your investment.

Some of these include education institutions, nearby public transportation, excellent accessibility, an array of established amenities, as well as upcoming future developments within close proximity.

Rule #2: Fully Understand The Current And Future Market Situation

It seems that everywhere you go now, you’ll hear talks of an upcoming property bubble. However, there are facts and numbers which seem to be telling a completely different story.

While there has been an oversupply of high-end properties that may be absorbed by the market in the medium term, the supply of affordable homes has been (for years) far behind the actual demand.

The Financial Stability Review 2018 by Bank Negara Malaysia (BNM) details how the supply of new affordable homes is still very much unable to catch up with the high demand.

This scenario then applies upward pressure on the prices of properties overall.

This situation then becomes the cause of the increasing amount of unsold units (also known as a ‘property overhang’), including uncompleted projects.

BNM also went on to state in a news report that for households earning the median income of RM5,228 (the figure published in the Statistics Department’s Household Income And Expenditure Survey), the price of an affordable price should be capped at RM282,000.

As for claims from other parties that properties in the price range of RM300,000 to RM500,000 were in the ‘affordable housing’ category, BNM has said that it is "inaccurate".

Rule #3: Look For Demand Drivers

Good developers will carefully build project according to demands, as potential buyers who’ve done their homework will always ask about the demand factors that set it apart, before confirming on a purchase.

Some examples of these factors include determining any future infrastructure (such as the High-Speed Rail).

There’s also Putrajaya Sentral (which the HSR will have a stop-over in), which is located almost in the middle of the Southern Corridor of Klang Valley, and is poised to become another central transportation hub.

This will create a long-lasting demand and eventually, the property values in that vicinity will see a rapid rise.

Rule #4: Identification Of The Correct Location

The most talked about point by all property experts: location! Places which are highly accessible are always recommended since mobility is something that cannot be taken for granted.

As property prices are tied to the scarcity of developable land and the land cost, it comes as no surprise that the Southern Corridor of Klang Valley.

Like Semenyih and Bangi is now becoming the next hotspot for developers and consequently, investment.

Let’s take, for example, Puchong. In 2006/2007, that area was once muddy lands with mostly industrial projects, looked upon as a ‘cheap’ destination without any chance of capital appreciation.

At that time, residential properties could be purchased for as low as RM180 psf. But in less than 10 years, the residential value has increased tremendously.

Puchong has now become the new ‘PJ in the South’, or seen as the extension of it.

By 2020 onwards, the rest of the Southern Corridor is expected to follow the same trend, by becoming the next hotspot for those looking for highly profitable property investment.

It’s also important to note that Malaysia’s top 20 developers have now made their presence felt with medium and big townships in these locations.

Rule #5: Look For “Scarcity”

If you’d like to be a smart investor, you should be on the lookout for something that nobody else is having, whether it’s in terms of design, size, features or facilities.

Now, imagine that you’re buying into an apartment block which offers 1,000 units in two sizes: 800 sq ft and 1,500 sq ft. The smaller ones make up 85% of the total number of dwellings.

If you purchased the 800 sq ft unit, you’ll be able to save money (obviously), but you’ll have tough competition in terms of resale and/or renting out once the project is completed.

So, you’re going to need to find a way to differentiate your unit from the others, whether it’s clever interior designing or even remodeling and renovation.

As a smart investor, do a proper survey of the available projects.

Look for the unique selling points (USP) of a project that will help make your unit more appealing, and thus allow you to get tenants or buyers without much hassle.

Rule #6: Health Of Malaysian Currency

The Iskandar Malaysia project is a good example of this point. It became a hit due to its close proximity to our neighbouring country, Singapore.

The exchange rate of both currencies was the demand driver here; a middle-class earner in Singapore can easily earn up to SGD3,500 a month

Thus, homes in the development was considered to be quite affordable for them. The situation is similar if you were to compare Greater KL and the Southern Corridor of Klang Valley.

More and more people are seeking higher paying jobs in Klang Valley but prefer to make the Southern Corridor of Klang Valley their residential address – more earning power, less money spent on accommodation (lower cost of living)!

In terms of earnings, there’s a 20% pay difference in KL versus other areas such as Kajang, Bangi or Semenyih. And what about your food?

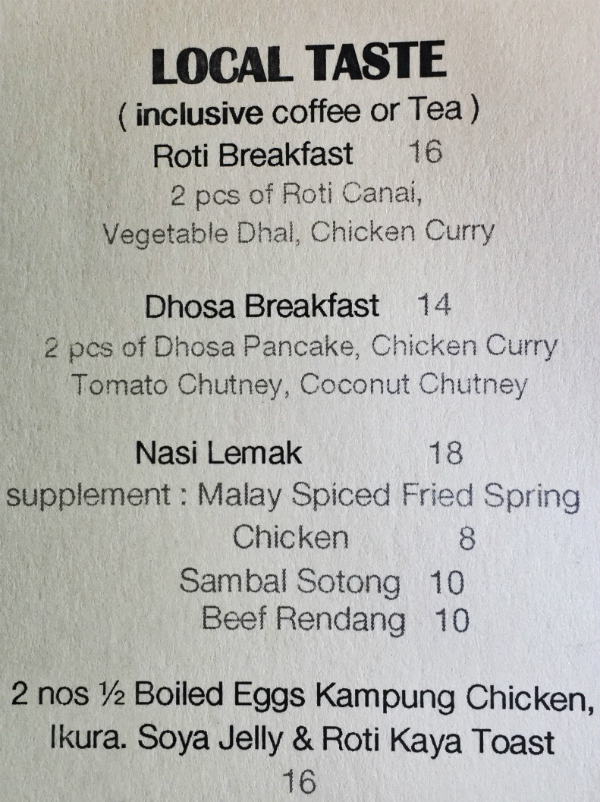

Well, a typical mamak restaurant in Kuala Lumpur, Mont Kiara or Bangsar can charge around RM16 for a roti kosong or RM18 for a nasi lemak.

Meanwhile, in the southern areas, the same meals can be purchased for as low as RM2. Below is a sample of a menu which was taken from a restaurant near the KLCC area.

As long as you keep these golden rules in mind when you’re on the lookout for the perfect property, whether it’s for your own stay or investment purposes, you’ll at least be able to make a more educated decision!

———-

Source: Dr Daniele Gambero

Relevant Guides:

-

Overnight Policy Rate (OPR) In Malaysia: Why It’s So Important

-

Base Rate (BR), Base Lending Rate (BLR), Standardised Base Rate (SBR): All You Need To Know

-

3 Infrastructure Developments That Can Transform Property Prices In Malaysia

Keep Track of New Launches

Visit our new launches page to find the new launch project of your dreams and submit an enquiry today.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.