Buying a property is the ultimate financial goal of many Malaysians. Despite the market’s recent slowing, property prices continue to rise.

As such, it’s no surprise that first-time homebuyers remain bleak about the prospects of securing their own home.

But, there’s still hope. A modern-day opportunity enables first-time homebuyers to discover a new way to buy and own property – much, much sooner!

The traditional approach to repaying a home loan is being turned on its head. Many are using technology to fast-track their homeownership.

A first-time homebuyer can now rent out a spare room for the short-term, and repay the home loan much faster.

Historically, the purpose of a residential property investment was binary: you either lived in it, or rented it out. Today you can do both!

Homesharing: a global accommodation solution

Homesharing is now a global phenomenon. Ordinary people share their homes with travellers from all over the world.

This is not a new concept, but recent technology has revolutionised its scale and scope. Now a homeshare can be booked in virtually any town on the planet.

Booking platforms like Airbnb easily allow homeowners to turn their passive residential investment into an income-earning asset.

From humble beginnings…

Airbnb started when two university graduates struggled to pay their rent in San Francisco. They shared their “air-bed and breakfast” for a fee.

Today Airbnb is the world’s largest hospitality group. Every night, over 2 million guests stay in one of the 6 million listings located in 191 countries.

To give you a sense of the scale of the platform: As of August 10 2019, there are 4 million people who have spent the night in an Airbnb listing.

The opportunity for first-time homebuyers

Homesharing is central to the concept of the sharing economy: taking what is already there and making the excess capacity available to those who need it.

What drives the potential for income from your home? Travellers!

Homesharing income is derived from the growing demand for international and domestic travel and the supply of accommodation to meet this demand.

Malaysia’s travel sector has increased strongly in the last decade. International visitor arrivals have grown by over 16% since 2008 to almost 26 million and there were 221.3 million domestic travellers last year.

Hotels traditionally have provided formal accommodation for travellers, but now the homeshare sector is recording strong occupancy.

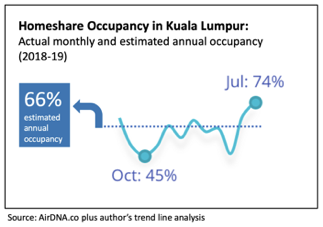

AirDNA’s data for Kuala Lumpur estimates homeshare occupancy of 66% for the past year, a similar level to occupancy recorded by Kuala Lumpur’s hotels.

This suggests strong acceptance of homeshares by travellers and indicates they are price and product competitive relative to hotels.

The growing travel market paints a bright future for homesharing in Malaysia.

How much can you expect to earn?

A useful resource for anyone interested in homesharing their property is an Airbnb calculator which estimates what you could earn: Airbnb Estimate.

The Airbnb platform is easy to use, offers flexibility for switching availability of your spare room on and off, and allows you to set your own prices.

And to keep you, your home, and your belongings safe, Airbnb covers every booking with US$1 million in property damage protection and another US$1 million in insurance against accidents.

How to own your home sooner…

Homesharing gives you potential to repay your home loan faster and own your property sooner – potentially in a third of the time of a traditional loan.

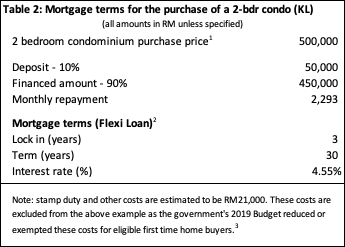

How? Let’s use an example of a young working couple with combined monthly incomes of RM6,000.

Based on their income and assuming deposit savings of 10%, the couple could afford a property worth RM500,000 located in Kuala Lumpur.

A quick glance at PropertyGuru.com.my lists for sale over 3,000 2-bedroom condominiums, priced between RM400,000 to RM600,000.

Standard terms offered by a Flexi Loan mortgage are summarised below:

Listing platforms like Airbnb allow homeowners to do both, by facilitating the short-term rental of spare rooms.

Comparing two short-term rental scenarios with the traditional long-term approach, Table 3 shows that income and gross rental yield generated from renting a spare room can exceed or generate almost the same annual income as renting the entire apartment long term.

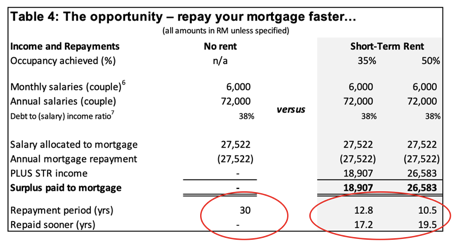

Assuming that the long-term rental of the condominium is not an option, renting out a spare room generates extra income for topping up home loan repayments. Doing so dramatically accelerates the pace of repayment.

Assuming the private room is rented 35% of the time and using a Flexi Loan, all of the additional income is effectively put towards the home loan, and the standard 30-year mortgage is repaid in less than 13 years (see Table 4).

If occupancy increases to 50%, repayment is even faster. The property is fully owned in ten-and-a-half years. That’s almost one-third of the time required to repay a standard home loan!

A final thought

Homesharing is a new way of improving the first homebuyer’s property affordability and fast-tracking their home loan repayment.

If you’re a first-time homebuyer and are wondering how you can afford to enter the property market, and how you can expedite your home loan’s repayment, offering a room for short-term rent is a very attractive strategy.

And Airbnb makes the renting process really simple and easy. To discover your earnings potential by renting a spare room and hosting, click: Airbnb Estimate.

———-

Keep Track of New Launches

Visit our new launches page to find the new launch project of your dreams and submit an enquiry today.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.