This article was contributed by Gary Chua from Smart Financing

What is a ‘mortgage’? In the financial world, it is a secured loan where the collateral being used is real estate property.

Of all the facilities that you have taken up with your banks, your mortgage is one very unique product where the property value appreciates over time, while your loan depreciates over time.

With this in mind, this positive value asset can then be used to generate additional cash flow for you. Best of all, it’s nearly a free cash flow for you. More on why it is nearly free will be explained shortly.

There are many common reasons why homeowners or investors refinance their properties:

- The opportunity to obtain a lower interest rate (This is where the mortgage was taken some time ago when it was more expensive back then)

- The chance to shorten your mortgage loan tenure

- The opportunity to tap into the property’s latest market value in order to finance a new purchase

- Debt consolidation

- The desire to convert to a different mortgage product type (Fixed mortgage term loan, Flexi-mortgage loans or semi-Flexi mortgage loan)

Why We Should Refinance Our Properties

1. For A Lower Interest Rate/Effective Lending Rates (ELR)

This is pretty straightforward. If a competitor bank offers you a 1% or 2% reduction in interest rates, you will definitely be saved from paying more interest. This also translates into a lower monthly installment.

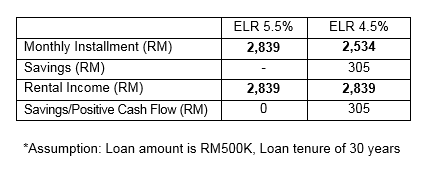

If you are renting this property out, you may be able to improve your rental cash flow position from a potentially negative to positive cash flow since the installment is lower now. See illustrations below.

2. Shortened Mortgage Tenure

You may shorten your mortgage loan tenure when you refinance your house. This would allow you to have savings on total interest that you need to pay to the bank. See illustration below.

However, should the Base Rate (BR) or Base Lending Rate (BLR) drop in the future, you can opt to refinance to a shorter tenure by maintaining nearly the same monthly instalments.

This means that you pay the same as you have always been but you are still able to pay off your mortgage loan in a shorter period of time.

EDITOR’S NOTE: On 11th August 2021, BNM released a revised Reference Rate Framework, which stated that a Standardised Base Rate (SBR) will be replacing the BR as the reference rate for new retail floating-rate loans.

3. Cash Out To Finance A New Purchase Or Other Needs

Refinancing to cash out with the purpose of making a new property purchase is something which needs thorough thinking.

Though it sounds exciting cashing out from your property that has appreciated by 50%, do note that the cash out should be spent on assets, which will generate further income or appreciation.

The cash out from refinancing is often used on home improvement / renovation, which can tremendously improve the property and lead to better market value on the property.

There are homeowners who refinance with the purpose of furthering their child’s education, wedding funds, overseas trips, starting a business, purchasing expensive goods such as furniture, fixtures, cars and so on.

In view that most of the banks in Malaysia do offer Flexi-mortgage options, if you decide to refinance your property with additional cash-out and have no idea on what to do with the funds yet, here’s a suggestion:

Leave it in your mortgage Flexi account in order to save some interest!

As such, you will have standby cash on hand without the need to pay additional interest on this cash until you utilise it.

4. Debt Consolidation

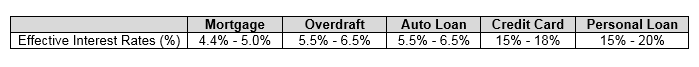

A mortgage loan is the cheapest financing option in town as compared to overdraft, auto-loan/hire purchase, credit cards, and personal loans. Refer to the table below for the financing rate comparison:

With regards to debt consolidation, refinancing would help if you have chalked up debts where their interest rates are relatively higher than that of a mortgage loan.

For example, a credit card charges an effective rate of 15% to 18% and up to as high as 20% for a personal loan.

Compared to the mortgage interest rate of <5%, credit card and personal loan interest rates are approximately 3 to 4 times more expensive.

A savvy consumer (like yourself since you are reading this article now) will use the refinancing money to pay off the credit card or personal loan’s outstanding balance to enjoy potentially 3 times or up to 4 times interest savings.

5. Changing To A Different Mortgage Type

If you are having a variable rate loan (pegged against the BR or BLR) but anticipate that there will be major interest rate hikes (for instance, higher OPR rate adjustment), it would be great to refinance your mortgage into a fixed rate loan now.

This way, your monthly installment amount does not increase even if BR/BLR increases.

Conversely, converting from a fixed-rate loan to a variable rate loan can also be a sound financial strategy, particularly in a falling interest rate environment.

If rates continue to fall, the periodic rate adjustments on BR or BLR will result in decreasing ELR and lower monthly mortgage payments, eliminating the need to refinance every time the rates drop.

What Are The Costs Involved?

Before you take action in your home refinancing, there are a few items you will need to take note of:

1. Moving Cost

This refers to money you would need to spend on in taking up a new loan. Items such as valuation fees, legal fees, disbursement, and stamp duty are payable when you refinance.

If you are refinancing to save on interest, take note of this amount and compare it against the savings in interest you would obtain through refinancing. The fee structure is as illustrated:

Do note that these fees may vary and are subject to change from time to time.

2. Mortgage Lock-In Period

When you are ready to pay off your existing loan early (before the tenure expires), check if your existing loan has a lock-in period and if you are still bound by it.

Banks normally charge a penalty of 2% to 5% (on your original loan amount) if you fully pay off your mortgage within the first two to five years.

This “two to five years” period, where you will incur a penalty for early settlement, is essentially the “lock-in period” of your mortgage.

What Are The Processes Involved In Refinancing?

The process is quite similar, just like applying for a new mortgage loan. The steps to refinance your mortgage loan are as follows (assuming you have identified your objectives of refinancing):

1. Firstly Check Your Current Mortgage, Whether It Is Still Within The Lock-In Period.

2. Contact A Few Banks To Find Out The Deals That They Are Offering.

The things that need to be taken into consideration will be the ELR, the moving cost, whether it is zero moving cost or partial moving cost is absorbed, and check if there is a lock-in period.

Evaluate all these deals to see which of them are important enough, and align to your objectives set earlier.

For example, if your intention is to cash out where funds may not be used now but later, getting a flexi loan but being required to sacrifice to a longer lock-in period would be ideal. Only submit to the bank which meets your objectives.

3. Always Negotiate For A Better ELR If You Are Not In A Hurry To Cash Out.

Then, compare all your banks’ offer before deciding which bank to proceed with.

4. Finally, Choose The Better Fit, Sign Up, And Enjoy Its Benefits!

Common Misconception On Cashing Out From A Refinancing Loan

The debt service ratio (DSR) of the additional cash out portion of your newly refinanced loan application will be calculated based on a 10 years repayment period.

The portion used to pay off your existing mortgage will still be based on normal mortgage tenure, that is up to 35 years.

But the above is merely the calculation of affordability, or debt service ratio. It has no impact to your actual refinanced mortgage tenure. This is illustrated below:

Customer A has an existing mortgage of RM250,000 outstanding balances and refinances the said property with the market value of RM600,000 mortgage application.

Although your bank officer informs you that they would compute your repayment capacity based on a 10-year tenure, the cash out amount then has no impact on your actual mortgage tenure – and most importantly on your monthly mortgage repayment.

This is done to ensure that you have strong repayment capacity.

Refinancing mortgage loans are a popular option as they’re relatively straightforward and easy to carry out. However, one must remember to exercise caution before jumping into such a decision.

|

Pros of Refinancing Mortgage Loan

|

Cons of Refinancing Mortgage Loan

|

|

Able to obtain lower interest rates/Effective Lending Rates (ELR) than your current loan.

|

Penalty charges may be incurred on early repayment.

|

|

Mortgage tenure can be shortened.

|

The value of the previous payments made may be defaulted or lost if the loan is almost settled .

|

|

Can be cashed out to finance other needs (home renovation, business plans, children’s education, etc.)

|

May require additional costs for refinancing to go through (example: moving cost).

|

|

Consolidate debt to save on interest.

|

Approval is not guaranteed as banks will need to take into account your existing credit score and income .

|

|

Mortgage loan type can be changed to save money, especially if there might be interest hikes/drops.

|

If refinancing is not the option for you, fret not because….

What Is The Alternative Besides Refinancing?

The top-up loan will be the alternative. It is an additional loan on top of the current mortgage outstanding amount and it is based on the appreciated market value of the property.

Some banks may open a new account for the additional top-up (i.e. 2 accounts to be serviced) while some banks may just top it up on the same account, which means to continue with the same account.

The top-up loan can only be done with the same bank from your original loan and most of the time, the bank will follow all the terms and conditions of the existing mortgage features.

You can read more about the different types of property loan in Malaysia with this guide. Also, view the latest Base Rate (BR) from different Malaysian banks here.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.