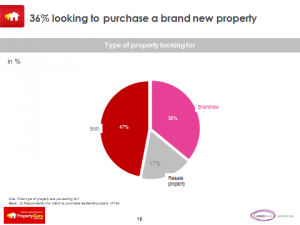

Despite the ample supply of homes on the secondary market, up to 36% of Malaysians prefer to buy a new home rather than buy from the secondary market. This was revealed in a recent study by PropertyGuru.com, the region’s leading property site for property listings and marketing intelligence.

PropertyGuru’s Malaysia Property Market Sentiment Survey Report showed that a large segment of potential homeowners would still prefer a new home as their first choice compared to 17% who would look to the secondary market as their preferred choice. In fact, one in two buyers will continue to visit developers’ showrooms rather than go through real estate agents to check out the latest products available in. A copy of the full report is available for download via http://goo.gl/x5DQIY.

While there are plenty of good deals to be had on the secondary market and there is the benefit of being able to physically see and experience the property, potential buyers have cited a slew of compelling factors that speak in favour of buying a new home.

One of the key reasons cited includes attractive sales packages from property developers, especially for middle income or younger buyers who may not have plenty of capital or savings to cover initial purchase costs such as the 10% down payment, legal fees and moving costs and so on.

“As mentioned before, many Malaysians, especially from the middle-income mass segment are in the perfect storm” of unaffordable house prices, lack of savings for a downpayment and the inability to secure a loan."

"Hence, it’s not surprising that many buyers aged 35 and below, will find sales packages by developers attractive as these are structured to reduce initial upfront costs and allow them to become homeowners. Factor in other incentives such as free home appliances, fixtures and so on and the total offering becomes very attractive,” explained PropertyGuru Malaysia Country Manager, Sheldon Fernandez.

According to the PropertyGuru Sentiment Survey, most Malaysians opt for 90% home financing (47% of survey respondents) while 12% managed to secure 100% home loans. 25% of property buyers accepted home financing of 70%-80%.

With regards to dipping into their Employee Provident Fund (EPF) savings, 47% of survey participants have yet to utilise their funds in EPF Account II, while 31% have used their savings once. Another 11% have withdrawn more than once to buy a property. 11% of the participants did not qualify.

The survey also touched on other factors highlighted by buyers. These included fewer problems with bank valuations when applying for financing, reduced concern on maintenance issues and the simpler process of dealing with one party rather than having to engage real estate agents or even haggle with sellers.

“There is often a nagging concern of whether I have negotiated the right pricing, especially when it’s your first time. Is there something that the owner and agent are not telling me? The learning curve can be high with a good chance for mistakes to happen,” added Fernandez.

Due Diligence Still Recommended on New Homes Before Buying

While purchasing a new home may look like the hassle free solution to home ownership, buyers are still advised to conduct their due diligence, which includes research, comparing different products in the same area including price per sqft and other factors.

Importantly, buyers are advised to seek information from independent 3rd party sources which include checking out online sources such as PropertyGuru’s New Project Reviews section.

Written from a consumer perspective, the New Project Reviews provide non-biased, comprehensive, and buyer-centric information that covers comparative sq.ft. price, cost and useful “neighbourhood” insights such as traffic conditions, social amenities, safety and security and more to better reflect the reality of living in a particular location.

Thus far, more than 200 new projects and neighbourhood reviews have been added, with the number to hit 400 by year end – covering almost every project to be launched in 2016.

*****************************************************************************************************************************

PropertyGuru’s Malaysia Property Market Sentiment Survey Report is an on-going insight effort to feel the current market pulse and the sentiment of consumers with regard to the domestic property market. It is the only independent local survey to do so with similar exercises carried out concurrently in Singapore, Thailand and Indonesia.

The Property Sentiment Survey was conducted by PropertyGuru in collaboration with Added Value-Saffron Hill, a Singapore-based independent professional research agency to strengthen the rigour and credibility of research findings. The aim of the Property Sentiment Survey is to help consumers and property agents gain an insight into the local property market to make better business and buying decisions. A copy of the full report is available for download via http://goo.gl/x5DQIY.