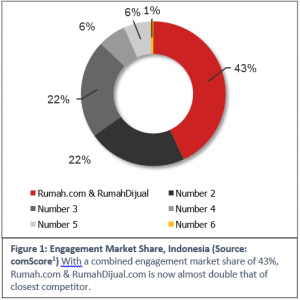

- Now holds 43% combined engagement market share, almost double that of closest competitor

- Indonesia is now PropertyGuru’s second biggest market in terms of traffic

KUALA LUMPUR, 3 December 2015 – PropertyGuru Group, (“PropertyGuru” or the “Group”), Asia's leading online property portal group, announced today that it has acquired RumahDijual.com, one of Indonesia's leading property websites, for an undisclosed amount.

This comes on the back of its latest acquisition of leading new project marketing solution, ePropertyTrack, in July, following an S$175 million investment from a strategic consortium of three investors including Emtek Group – Indonesia’s largest media group – in June.

Founded by Indonesian Yohanes Aristianto, RumahDijual literally means “house for sale.” The acquisition of RumahDijual.com, coupled with PropertyGuru’s Rumah.com site, has cemented the Group’s market leadership in the country.

It means that 43% of all time spent on property portals in Indonesia is now spent with PropertyGuru (refer to Figure 1; source: comScore[1]), almost double that of its closest competitor. Currently, Rumah.com and RumahDijual.com combined have 5.5 million users and 30.2 million page views monthly[2] - making Indonesia PropertyGuru’s second biggest market in terms of traffic.

Steve Melhuish, CEO and Co-Founder of PropertyGuru, said, "Indonesia is strategically important for PropertyGuru because it is the largest, and one of the fastest growing, property and digital markets in Southeast Asia. Together with our local partner, Emtek, we have earmarked tens of millions of dollars in the coming years to bring further innovations to the Indonesian market, to help solidify our market leadership."

"This latest acquisition is a further testament to our long-term commitment to the Indonesian property market. We bring market transparency with an unrivalled volume and diversity of choices, relevant and reliable information, and innovative search experience to home seekers, helping them to make more confident property decisions. And to our trade customers we bring a comprehensive suite of sales and marketing services, on top of increased leads, due to a wider reach.”

Rumah.com has engaged in numerous investments and market engagement activities to solidify its leadership position in Indonesia. Over the past two years, Rumah.com has invested in innovations such as a recent mobile app refresh, a website revamp in Q3 2015, and the incorporation of a mortgage calculator in its website and mobile applications, in order to make home affordability more transparent. As a result, consumer visits to Rumah.com have grown by 22%[3] year-on-year, with mobile traffic growth of 53%[2].

PropertyGuru’s upside opportunity in Indonesia is tremendous as it has great potential to become a high growth and high demand market driven by its booming population growth, an emerging middle class, rapid urbanisation and growth in mobile internet consumption. This growing population will benefit from the widest variety of property choices with PropertyGuru’s acquisition of RumahDijual.com, with close to 500,000 listings across the major islands in Indonesia.

Indonesia has the largest population in the Southeast Asian region with approximately 256 million people and growing by another 2.4 million people (working age population) per annum[4]. Its GDP is currently growing at 5% per annum (2014 estimates), with 53.7% of its total population considered urbanised. In the last five years, the country registered an average urbanisation rate of 2.69% annually[5], lifting millions from lower income socioeconomic levels to the middle class and/or affluent categories.

This has led to a rapid urbanisation where 68% of its population is expected to be living in cities and this figure will increase to 82% by 2045[6]. A rise in affluence also translates into a surge in mobile internet consumption, and according to Frost & Sullivan, Indonesia will have around 1.7 billion connected devices in 2020, with over 470 million mobile subscribers and over 200 million active internet users[7].

PropertyGuru in Malaysia

With the latest acquisition, PropertyGuru Group further solidifies its position in the region as the leading property portal with 43% engagement market share[8] in Indonesia, 91.8% in Singapore, 52.7% in Thailand, and a close second in Malaysia with 40.2%.

Malaysia remains PropertyGuru’s fastest growing property market with offices in Kuala Lumpur, Penang and Johor. PropertyGuru has been taking the lead in the mobile space in Malaysia with the consumer mobile and Agent app on Android and iPhone platforms. The mobile apps have proved to be highly popular since launching in 2012, with more than 40,000 active users and 2.5 million downloads on the PropertyGuru Mobile App. The Malaysian portal currently has over 1.8 million visitors viewing more than 13 million property pages monthly, attributed to a large growth in agent members, real estate developers and bank clients.

References:

[1] Based on PropertyGuru’s calculation with data from comScore Media Metrix Indonesia report, Sep 2014 to Aug 2015, Total Minutes, entities included top 7 property verticals captured by comScore.

[2] Based on data from Google Analytics, including traffic from Consumer Web, Mobile and App, for October 2015.

[3] Based on PropertyGuru’s calculation with data from Google Analytics, comparing consumer visits from October 2015 with October 2014.

[5] https://www.cia.gov/library/publications/the-world-factbook/geos/id.html

[6] http://theconversation.com/a-crowded-city-can-be-a-sign-of-a-good-thing-for-indonesians-30401

[8] Based on PropertyGuru’s calculation with data from comScore Media Metrix Singapore report, using 6-month average from Mar 2015 to Aug 2015, Total Minutes, entities restricted to property verticals captured by comScore.