Malaysia is a wonderful place to live. Not only is it considered one of the more affordable places to live in Southeast Asia, it also maintains its title as the best country to retire in.

This means that if you’ve started searching for houses for sale in Malaysia, you’re already on the right path to setting up a successful future!

While the Malaysian property market has been up and down in recent years, the good news is that right now is a great time to buy in Malaysia.

It’s a buyer’s market, and first-time homebuyers – including foreigners looking to buy a property in Malaysia – will find they can afford a property.

But having enough money to buy a house isn’t the only thing to consider. Here’s a checklist of factors you need to think about while searching for your perfect Malaysian property.

1) Make Sure You Do Plenty Of Property Research

Whether you’ve lived in Malaysia your entire life, or have recently moved here and are looking to buy a home, research is the most important thing you can do before jumping into the housing market.

Malaysia is a big country with plenty to offer, but which location will best suit your needs?

Understanding what land types are available to you will set you on the right path, as well as gaining knowledge about lending guidelines in Malaysia and how to find the right developer.

Whether you’re searching for a home as a young couple, a family or as an investment property, consider your needs with regards to:

- Location.

- Amenities.

- The age of the property.

- Whether you want to buy a completed property, a sub-sale property, or a brand new home that is still under construction.

Although your research in its entirety is extremely important, the most significant findings you will uncover are about how a property speaks to you.

Can you picture yourself living there and being happy? That’s the key!

2) Consider Your Budget Carefully

Of course, money is important – and probably the defining factor for every person searching for a property in Malaysia.

Malaysia’s real estate market is set to slowly recover in 2021 and if you plan well, you could easily own your first home soon enough.

PropertyGuru Tip

When considering your budget, the general rule is that your loan payments each month should not go beyond one third of your income.

For example, if you are a couple with a combined income of RM12,000, your monthly repayments should not be more than about RM4,000.

We know that many Malaysians want to buy property, but aren’t willing to change their lifestyle to afford one, so understanding what you can realistically purchase (while still being able to go out with friends or afford your car repayments) is very important.

As for down payments, you’ll need to ensure you have the 10% to pay upfront.

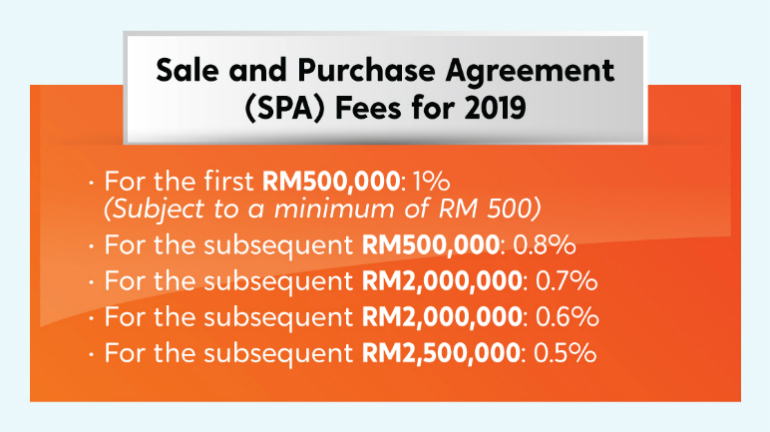

Apart from this, other additional costs such as the legal fees, the real estate agent’s commission, and stamp duty are all important to consider.

Generally, most banks in Malaysia offer loans of around 90% of the property’s price for your first two residential properties.

3) Understand Property Types And The Risks Of Your Investment

Are you looking for a condominium, apartment, terrace house, semi-detached, bungalow, or SOHO?

Do you want to purchase a unit in an older – but potentially cheaper – building, or perhaps a sub-sale unit before it’s completed?

Deciding on your property type is one thing, but then you have to weigh all the pros and cons and the average property prices, which vary significantly.

Location is a key component of this. For example, if you bought a single-storey house in Bangsar 15 years ago, you might get a return of more than 200% of what you paid today.

This is because the location of Bangsar has exploded in popularity – and you might not find the same capital appreciation elsewhere.

Other risks include Malaysia’s typical property cycle, which dictates whether the property prices go up or down.

At the moment, Malaysia is in what is called a ‘downturn’, where there is an abundance of residential properties for sale, with many remaining unsold for a long period of time.

So, if you’re looking to purchase now, you need to understand not just what this means, but how it can factor into your decision-making process. A few questions to consider are:

- What could the long-term effects of purchasing a house during a downturn be?

- If you’re looking for a rental property, what’s your rental return likely to be?

- How easy will it be to find tenants, based on your location, nearby amenities and costs?

- How many repairs to the property or unforeseen costs could there be that might affect your cash flow as a homeowner?

Remember, return on investment is never guaranteed, and outlooks can change year-to-year, influenced by complex factors.

PropertyGuru Tip

Be thorough in your research, and consider as many factors as possible before deciding to buy!

4) If You’re A Foreigner, Know What Property You Can Buy In Malaysia

Unlike in many other countries, foreigners have a lot of choice when it comes to buying property in Malaysia.

From condos, apartments and landed houses, there are few restrictions to owning property on a freehold basis.

However, if you’re a foreigner, you cannot buy Malay-reserved land or agricultural land, or land dedicated and earmarked for Bumiputera needs.

The main thing foreigners should note is that there are minimum investment requirements, which can vary by state, to allow you to buy a property.

This is so that more affordable properties are left available for the local market. Nearly 20 years ago, foreigners could buy properties for as little as RM250,000, but today the minimum investment is typically over RM1 million.

A renewable 10-year visa (called the MM2H/Malaysia My 2nd Home) allows foreigners to lower this price tag in certain states – but even with these restrictions, Malaysia remains one of the most foreigner-friendly property markets in the world.

5) Find An Experienced Property Agent

An experienced, engaged and friendly real estate agent can be worth their weight in gold. Not only will they work hard to find properties within your budget for you, but they’ll advocate for you, coordinate viewings and communications, and protect your interests.

When choosing someone to help you handle your buying process, make sure the property agent has a range of desirable traits that will ensure you get the best deal.

They should serve as your first line of defense against demanding sellers or developers, handle any mediations, and negotiate in your favour.

They should also, ideally, come with knowledge of the location you’re looking to buy in – from local amenities, travel times, distances to schools and other possible sale/purchase prices – to ensure you come out on top of your transaction.

Agent Finder

Connect with pros who can help meet your needs.

6) Begin Your Property Search!

While there’ll still be a few other details to iron out, such as where and how you will take out your loan, and whether you’ll engage an independent mortgage advisor, now it’s time for the fun stuff!

Start your property search online and get clicking! Have a look at what’s available and make a list of areas, bookmarking properties that seem in line with your wants and needs.

Take all things into consideration and collate all your research – don’t get swayed by family or friends who tell you unsubstantiated trends or rumours about property trends.

Finally, make sure you find out if what they’re telling you is true by asking people within the industry, and through reading plenty of current news about Malaysia’s property market.

Happy house hunting!

Planning to buy a property in Malaysia? Get in touch with one of our experienced agents to help you purchase your dream home.

Keep Track of New Launches

Visit our new launches page to find the new launch project of your dreams and submit an enquiry today.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.