Credit Reporting Agencies (CRA) such as CTOS have been operating for more than 20 years in Malaysia, yet was only regulated on 15th January 2014 with the enforcement of the Credit Reporting Agencies Act 2010 (CRA Act).

The CRA Act regulates the operations of CRAs that provide credit reporting services and is supervised by the Registrar Office of Credit Reporting Agencies, Finance Ministry.

What exactly do CRAs do and what is its role in society?

A CRA compiles credit information of individuals and businesses, and then provides it in the form of Credit Reports to credit grantors, such as banks, so that an objective assessment can be made on the likelihood a borrower is able to repay their loans.

According to the International Financial Corporation (IFC), this helps to satisfy lenders’ need for accurate, credible information and reduces the risk of lending and the cost of loan losses.

As such, the availability of CRAs in an economy enables access to credit, quickly and at a lower cost.

Before the enforcement of the CRA Act, there was very little supervision and control over how CRAs would collect and process credit information.

Unsupervised, CRAs were believed to have inconvenienced consumers whenever inaccurate credit information were provided to the credit grantors.

Thus, the enforcement of the CRA Act is highly appreciated by business institutions as well as consumers to ensure more reliable and accurate Credit Reports.

Today, there are 7 CRAs registered under the CRA Act, including:

- CTOS Data Systems Sdn Bhd

- Credit Bureau Malaysia Sdn Bhd

- RAM Credit Information Sdn Bhd

While the Central Credit Reference Information System is regulated by Bank Negara Malaysia under the Central Bank of Malaysia Act 2009.

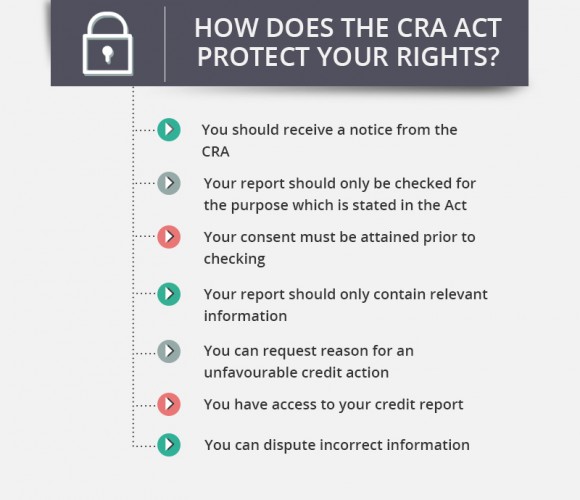

Besides preventing inaccurate information, the CRA Act also protects your rights. Here are the 7 consumer rights in credit reporting everyone should be aware of:

Know Your Rights

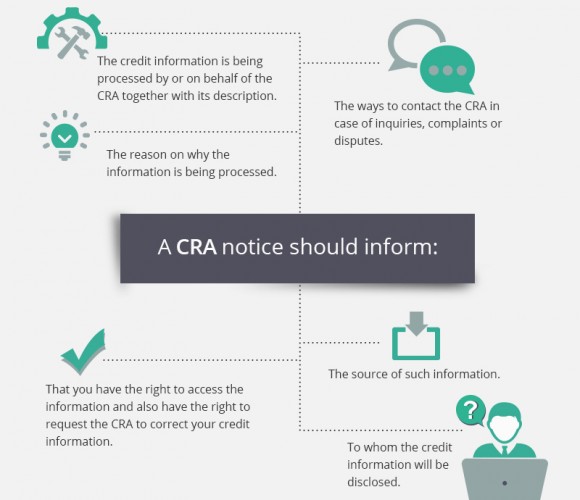

1. Notice From CRA

Prior to checking your status, a consumer must be informed of via a notice provided by the CRA.

2. Only For The Purpose Which Is Stated In The Act

Your credit information cannot be collected and used for any purpose other than what is provided under the Act, which means that a CRA may only collect and use your credit information to prepare a credit report.

This report on your credit-worthiness includes, but not limited to, any history of failure or diligence regarding payment of your bills (reputational collateral).

If the credit report was used for other purposes besides the one stated in the Act, and that you have information regarding the occurrence of such practice, then lodge a complaint to the Registrar.

3. Attaining Your Consent

A CRA must obtain your consent before disclosing or revealing your credit report to their subscribers or clients.

4. Only Contains Relevant Information

Your credit report can only contain information according to the Act, which means that a CRA cannot include the below credit information in their report regardless of attaining your consent:

- if the source of such credit information is not included in the report

- if such credit information is regarding any pending proceedings in the court which is over two years after the proceedings began and has yet to be settled

- if such credit information is regarding any default in the repayment of credit two years after the date of final settlement of the amount in default

5. Request Reason For Unfavourable Credit Action

You have the right to request information from the credit provider regarding an unfavourable credit action.

For an example, if your loan is rejected based on the report given by a CRA, then you have the rights to be informed of the identity of the CRA, as well as access to the said credit report.

6. Access To Your Credit Report

You have the right to access the credit information or credit report from a CRA which holds or have processed your credit report.

But the credit reporting agency must verify your identity, and confirm that such information is indeed in their database before complying.

This information will only be provided upon your request and upon payment of any fee which may be charged by the agency.

7. Dispute Incorrect Information

You have the right to dispute incorrect credit information which is provided to the credit provider in regards to the loan application made by you.

In the event of having wrong information, you have the right to challenge such credit report according to the procedures provided under the Act.

CRAs play an important role in efficiently providing credit grantors with credit information on a loan applicant and the introduction of the CRA Act will further increase the reliability and accuracy of Credit Reports.

Further, the CRA Act also puts a high focus on consumer protection with the 7 Consumer Rights on Credit Reporting as above.

As a consumer, it is important to know your rights and to ensure the credit information that has been collected by CRAs are accurate. You can take the first step to obtain your free CTOS credit report at http://www.ctoscredit.com.my/myctos and your CCRIS credit report at any BNM branch.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.