Whenever you apply for a loan or a credit card, financial institutions need to know that you can pay your debts.

To determine this, they refer to certain credit reports to indicate that you are in good financial standing in terms of debts.

Simply put: if you can pay your debts before, you are likely to be able to continue doing so!

Your credit reports (CCRIS and/or CTOS), alongside your income statements, will be your bank’s reference to decide whether to approve or reject your loans.

You can check your reports even before applying for a loan. So, what is this CCRIS and CTOS anyways? Let’s check it out!

The Differences Between CCRIS And CTOS

CCRIS | |

|

What it stands for

|

Central Credit Reference Information System

|

|

Description

|

A system created by Bank Negara Malaysia (BNM) which compiles credit information about a borrower or potential borrowers into standardised credit reports.

|

|

Governing authority

|

Bank Negara Malaysia

|

|

Information in the report

|

|

|

Information source

|

All banks and financial institutions

|

|

Reports available

|

Free report

|

|

Access methods

|

|

|

Span of credit history archived

|

12 months

|

CTOS | |

|

What it stands for

|

CTOS Data Systems Sdn Bhd

|

|

Description

|

The role of CTOS as a credit reporting agency is to maintain a record of historical information about a person’s credit experience to assess the creditworthiness and repayment capabilities of individuals or business companies.

|

|

Governing authority

|

Privately-owned

|

|

Information in the report

|

|

|

Information source

|

Information on public domain:

|

|

Reports available

|

|

|

Access methods

|

Available online

|

|

Span of credit history archived

|

Indefinitely

|

*Price as of March 2019

Note: Both reports provide factual data. They don’t form any opinions on your financial health or creditworthiness, which is up to your lender to decide. Nor do they do any blacklisting!

READ MORE: How To Improve Your CCRIS: Do’s and Don’ts!

Sample CCRIS report

READ MORE: Here’s a more in-depth guide on how to get this report!

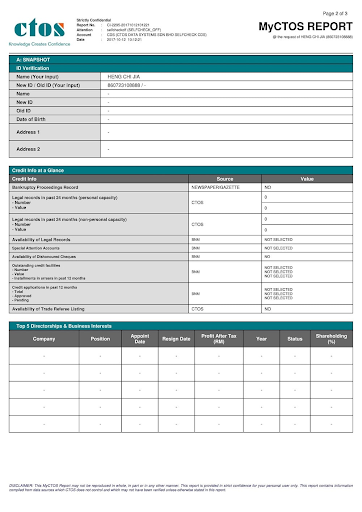

Sample CTOS report

What Is A Special Attention Account?

We’ve come to this ‘mysterious’ bit of information that you may find in your report! In certain cases, you might notice that one or a few of your loans are reported as a Special Attention Account in your CCRIS report.

A Special Attention Account refers to any outstanding credit facilities, like a loan or a bounced cheque, that is under close supervision by the participating financial institutions, particularly while the loan is being recovered or collected.

Under such situations, the financial institution will not be allowed to lend you money and you will need to contact them to find out what is really going on. Sometimes it might be a mistake by the bank, so it’s best to clear it as soon as possible!

The Special Attention Account usually occurs for Non-Performing Loans (NPL), but they do happen for loans with special debt management schedules as negotiated by AKPK too.

How Do These Reports Affect Home Loan Applications?

If your reports indicate that you are not in debt and are in good financial standing, the banks are more likely to offer a higher Loan-to-Value (LTV) / Margin of Finance to you.

This means you can borrow a higher percentage of the cost of your home. Check out these handy tips on how you can go about keeping your reports healthy.

Conversely, if you don’t have a good financial standing, or if you do not have a credit score at all, banks may choose to reduce the loan margin or increase the interest rate of your loan.

The worst case scenario would be that the bank will reject your loan application completely. To that end, it’s important for you to pay all your existing debts on time.

If you don’t have any, apply for a basic credit card just to establish a credit score, but make sure that you pay off any outstanding amount in full and avoid carrying it over to the next month!

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.