Earlier this year, many were faced with financial constraints and to ease the cash flow of individuals who are likely to be the most affected by COVID-19, Bank Negara Malaysia (BNM) announced that all banking institutions will provide an automatic deferment of all loan/financing repayments for a period of 6 months, with effect from 1 April 2020.

And ahead of the blanket moratorium ending on 30 September 2020, BNM recognised that income and cashflow challenges remain for some, especially those who have lost their jobs or experienced a reduction in incomes as many businesses and industries were badly affected by the pandemic.

Thus, BNM has been working closely with banks to ensure that assistance continues to be provided to borrowers with an extension of the moratorium and repayment flexibility to individuals and SMEs who continue to be affected.

With these measures in place, we asked consumers to share their sentiment on the government’s efforts in our Malaysia Consumer Sentiment Study H2 2020.

According to the study, Malaysians were most satisfied with BNM’s six-month financing moratorium, as reported by the majority (39%) of respondents.

Sheldon Fernandez, Country Manager, PropertyGuru Malaysia shares that the BNM moratorium was the right measure at the right time.

“Though the first phase of the moratorium is ending in September, it has already helped 43% of participants rebuild financial buffers. It also assisted them to manage costs of living (34%) and redirect resources to alternative investments (16%), all desirable outcomes given the challenges faced by many Malaysians in the wake of the pandemic”, he said.

The study, drawing from PropertyGuru’s position and reach as Malaysia’s largest property site with 450,000 listings, found that 44% of respondents opted in for the moratorium, indicating that many (48%) homeowners were confident in their ability to service loan instalments during the various Movement Control Orders (MCOs) and opted out. For those who opted in, the measure represented much-needed and timely assistance.

One interesting finding was that younger Malaysians were among the demographics most likely to opt in, with 43% of respondents aged 22–29 years old participating. This demographic was also most likely (34%) to be satisfied with government measures to stabilise the property market overall, along with those from low-income backgrounds (39%).

Government measures came in handy

While this banking measure provided a sigh of relief, other monetary concerns were still at large as MCO took a toll on the economy, various business, and industries. It was reported that unemployment rate in Malaysia had increased to 5.3% in May 2020 from 5% in April 2020 as the number of unemployed persons rose by 47,300 to 826,100 individuals, according to the Statistics Department.

These prolonged concerns prompted the launch of the Short-term Economic Recovery Plan (PENJANA), in which measures such as the Home Ownership Campaign (HOC), which will end on 31st May 2021, the exemption on Real Property Gains Tax (RPGT) and the lifting of the 70% margin on a home loan for the third residential property that’s valued at RM600,000 and above were introduced.

The study also polled Malaysians on which aspects of the property ownership journey they felt required government attention during the MCO and findings showed were in line with the market sentiment.

Findings from the study showed that young Malaysians and those from low-income backgrounds were most likely to cite satisfaction with measures introduced, due to the targeted nature of relief provisions in PENJANA and other recovery packages.

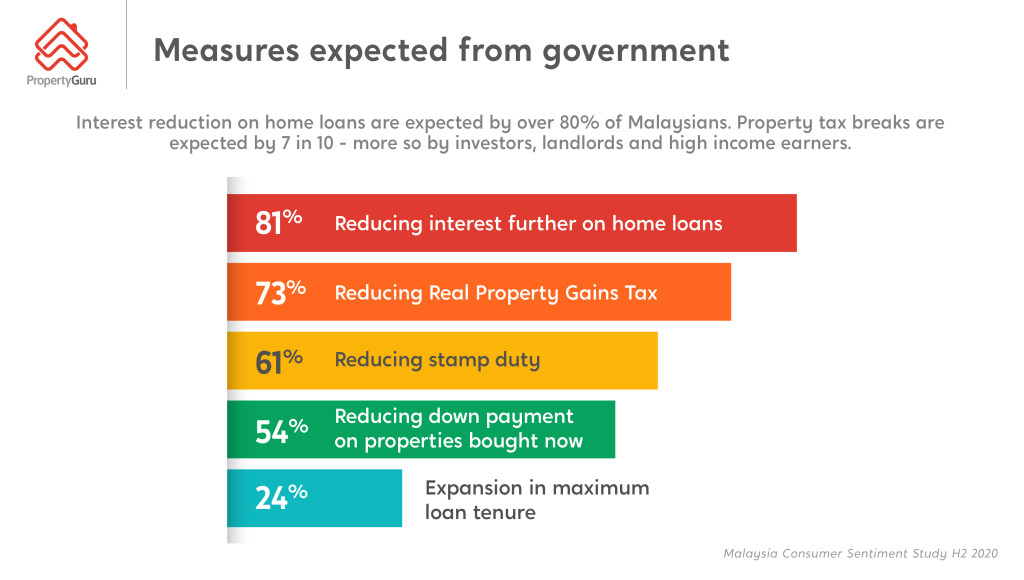

Respondents cited reduction of interest rates for home loans (81%), RPGT reform (73%), reduction of stamp duty (61%) and down payments (54%), as well as expansion in maximum loan tenures (24%) as part of initiatives they expect from the government.

Significantly, many of these challenges have been addressed by recent national initiatives, with the revision of BNM’s Overnight Policy Rate (OPR) to 1.75%, for example, bringing down home loan interest rates nationwide.

In addition, PENJANA included provisions for RPGT and stamp duty exemption into 2021, while discounts of 10% and more via the reintroduced Home Ownership Campaign tackled the issue of property prices – cited as the primary deterrent to property purchases by 93% of respondents.

“This is timely in light of a surge in home ownership interest among these demographics following months of restricted movement due to the outbreak,” said Fernandez.

“These findings reflect the success of the government’s initiatives targeting the B40 segment as well as youths. Young Malaysians will also be a focus in Budget 2021, which PropertyGuru applauds, given the surge of interest in home ownership in the demographic following months of restricted movement during the MCO,” he added.

“The impacts of the COVID-19 outbreak are undeniable, and it will take time to get the economy back on track as many Malaysians struggle with loss of income and employment. However, for those with financial buffers, this is the most conducive lending and policy environment that we have seen in recent years,” says Fernandez.

With these initiatives at place, it is no wonder confidence in the government rose as key home ownership challenges as cited by property stakeholders and home seekers are being addressed.

What are the trends spotted in the property market since OPR cuts were announced in 2020? Here are 3 points to begin with!

Keep Track of New Launches

Visit our new launches page to find the new launch project of your dreams and submit an enquiry today.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.