By now, you’re probably well-versed with what the COVID-19 pandemic is all about, and how global economies have been suffering from prolonged lockdowns because of the virus.

The Malaysian government announced the Economic Recovery Plan (ERP), or PENJANA, on 5th June 2020 in an effort to keep the economy afloat and provide assistance to individuals and businesses in critical need.

Among some of the incentives offered were certain measures designed specifically to boost the property market. Now, were they enough so far?

Not only are we going to take a look at facts and figures, we’ve also gathered some valuable insights from various industry experts to give us a clearer view. But first, let’s take a quick look at current conditions…

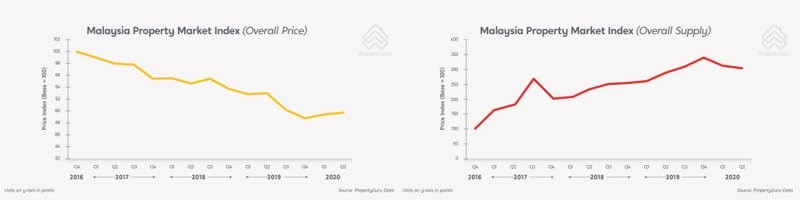

Present Property Prices And Supply In Malaysia

According to the PropertyGuru Malaysia Property Market Index Q3 2020 report, the overall asking prices for the entire country has remained relatively stable (+0.83% Quarter-on-Quarter [QoQ]) in Q2 2020, despite the Movement Control Order (MCO). However, there was a dip in the supply level of properties on the market (-3.60% QoQ).

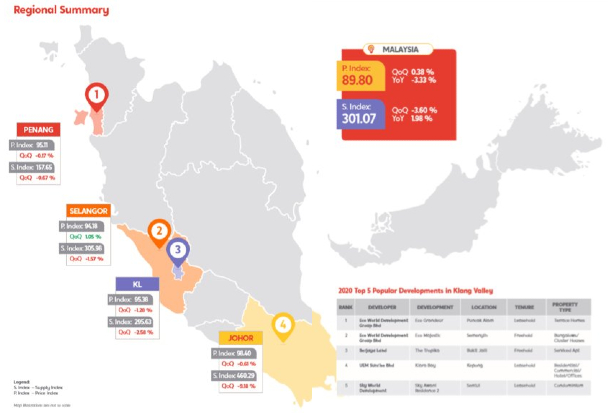

Looking at the region analysis of the 4 key states (Kuala Lumpur, Selangor, Johor, and Penang), it’s noted that 3 out of 4 of them witnessed a slight decrease in their respective Price Indices:

- Kuala Lumpur, -1.28% QoQ

- Selangor, +1.05% QoQ

- Johor, -0.17% QoQ

- Penang, -0.61% QoQ

“Kuala Lumpur has seen the sharpest drop overall, which could possibly be due to a couple of notable factors. One is that the KL property market is a focal point for foreign interest, but this has recently decreased due to international travel restrictions, and poor global economic sentiments.

“Luxury properties targeted at international buyers and investors in KL will likely take a big hit, unless prices are readjusted to suit local buyers,” said Sheldon Fernandez, Country Manager, PropertyGuru Malaysia.

He further went on to add, “There’s also an emerging preference for decentralised property locations, where homebuyers are moving away from KL and Klang Valley hotspots in the long-run. New hotspots that are especially along the Klang Valley/Seremban corridor which provides more spacious living at affordable prices are now generating plenty of interest”.

With those numbers in mind, it’s safe to say that Selangor remains one of the more popular locations that homebuyers search for, thanks to its vast network of connected highways, the myriad amenities within easy reach, as well as wide range of property prices that cater to people from all budget types.

What’s more, many property developers have been aggressively turning to digital marketing in order to promote their projects, most of which are located in Selangor.

Finally, Johor and Penang continue to show strong growth. For the former, it’s now in a good spot to cater to the domestic demand (more locals can now afford a home), in addition to its existing international appeal.

This is due to global economic insecurities that took place before the COVID-19 crisis, where foreign investment in the country experienced a downturn.

In turn, asking prices have been steadily declining, following an overheated period where investments once poured into Iskandar Malaysia.

For the latter, even though it recorded a drop in asking prices, there’s still a sustained interest from homebuyers. Limited space on the island and controlled development in recent years have contributed to a steady demand environment and generally stable prices. Penang is poised to receive more attention as state government measures fall into place to reduce overhang issues.

What Are The Effects Of Pricing During A Pandemic?

When it comes to setting the right selling price for your property, in order to meet an increase or decrease in demand, you don’t need rocket science to help you figure that out.

Don’t just look at the other properties for sale in the market; you’d also need to look at past transaction prices and the volume traded (buy and sell), in order to get an idea of future performance.

You see, more people wanting the location and/or your property type, would mean that you’d be very much lesser inclined to price low or give discounts.

“Using Big Data Technology, we analysed over 5,000 development launches, both past and present. Specifically, we focused on approximately 300 developments presently being marketed across various channels (advertisements, agents, social media, etc) to extract a median selling price,” said Joe Thor, CEO, MyProperty Data.

“We found that 45% of projects we analysed were ‘overpriced’ by over 10%, with some being overpriced by as much as 80%! Often, these mismatches correlated with the amount of incentives and rebates offered by the developer.

“This technique of overpricing leads to further inflation, as we have observed developers (and even individual sellers) now benchmarking against what other nearby projects are being marketed for. Left unchecked, this will result in spiraling inflation as prices are now benchmarked against inflated (pre-discount) prices, exacerbating an already severe affordability issue,” he explained.

Understanding How The Property Market’s Health Affects Pricing

According to Kai Wong, General Manager, Oriental Real Estate, there are 5 key attributes having an effect on property prices, which buyers and sellers both need to be aware of and monitor:

- Primary market supply and demand

- Secondary market supply and demand

- Bank lending rates

- Unemployment rates

- Commercial activity

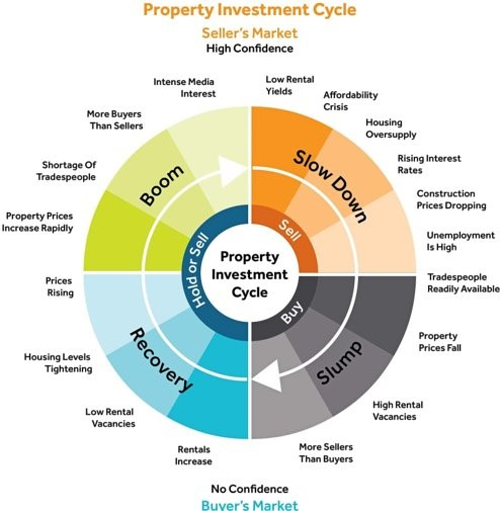

How do those 5 apply to our current market conditions, you ask? If we were to look at the chart below, it would seem like Malaysia is still in the remnants of a slump, and will continue to be that way for some time, despite some experts predicting otherwise.

Wong elaborated on that, saying “The trend we’ve observed is that a property cycle takes place every 8 to 12 years. We’ve now only been 6 months into the COVID-19 pandemic, and there’s also been the 6-month loan moratorium, which somewhat delayed the worst from taking place. It’s safe to say that we won’t be seeing much difference yet, in terms of a real property market slump, or changes in buyers’ demands and sellers’ pricings.

“But what we can say is that we’re seeing a decline in the volume of properties for sale, which corroborates with PropertyGuru Malaysia’s data. We can also see that demand is also slowly starting to decline in tandem, which means that it’s time to start worrying a bit. It’s because in the next 1 to 2 years, we’ll still be seeing a property overhang as there are still not enough initiatives/incentives from the government to encourage and assist homebuyers.”

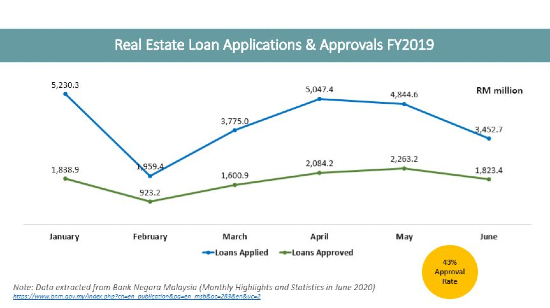

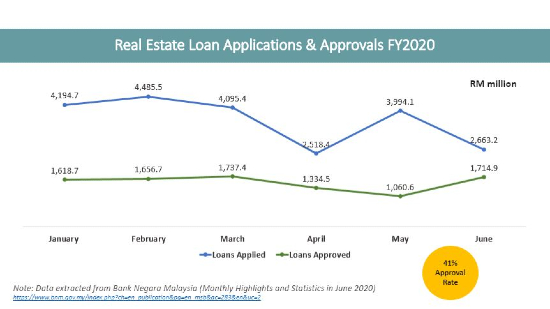

As can be seen in the line graphs above (data extracted from Bank Negara Malaysia [BNM]), the real estate loan applications and approvals in FY2020 stood at 41%, compared to the same period in FY2019 where it stood at 43%.

In addition, the amount of loans applied for and approved have also both dropped. In FY2019, there was roughly RM3.5 billion worth of loans applied, and roughly RM1.8 billion out of that was approved. In FY2020 though, there was roughly RM2.7 billion worth of loans applied, with only roughly RM1.7billion out of that amount gaining approval.

Finally, with commercial activity nationwide grinding to a complete stop during the MCO period, it came as no surprise that there was wave after wave of job cuts. The unemployment rate shot up to a record high of 5.3% in May 2020, thereby further dampening the already-gloomy outlook of buyers and sellers alike.

Know Who You’re Targeting When It Comes To Pricing

Just like how a movie is made with a specific genre in mind to target the right group of viewers, so too does this apply to sellers who are in the midst of deciding on what the ‘right price’ is.

Michael Lam, Property Consultant, IQI Global is of the opinion that there are in fact 3 types of buyer mindsets in the market today: First-time homebuyers, small-time investors, and big-time/groups of investors.

"First-time homebuyers are those who are really keen to purchase a piece of their own real estate, and a lot of them want to enter the market, now that the economy is on a decline. However, they’re also the ones who don’t have their documentations and profiles ready, as they’re not aware of what’s required and probably did not do much in-depth research.

Banks are now strictly choosing their clients to ensure they minimise the risk of defaulters. After all, even though the Overnight Policy Rate (OPR) is currently at an all-time low, it’ll rise again in the future and thus bring interest rates up (more expensive to pay monthly instalments) along with it," Lam stated.

He also explained that small-time investors are those who already have a property of their own, and would like to own one more to earn some additional income, either through rental or resell. They’re the ones who are more cautious in choosing a property that comes with the right price tag, and are less inclined to follow peer pressure.

On the other hand, big-time/groups of investors are those who come with the liquid funds, and would usually join a fund together, such as a Real Estate Investment Trust (REIT). Their mindset is to pool together their money and go for the big-ticket properties like shopping malls, hotels, and even industrial land.

As long as the property is priced right based on factors such as its type and location, this will help ensure that the banks will be able to approve a potential homebuyer for a housing loan. If you’re looking to sell your home now, make sure you know about the fees and taxes involved so that you’re not caught unaware!

Keep Track of New Launches

Visit our new launches page to find the new launch project of your dreams and submit an enquiry today.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.