The Perfection of Transfer (POT) and Perfection of Charge (POC) are both essential documents in transferring ownership of a property title. Yet, for some people, these can come as a bit of a shock!

We’re all so excited about the Sale and Purchase Agreement (SPA) or even the Memorandum of Transfer (MOT) that we overlook that final hurdle before a deal is done.

These two important documents are worth knowing about, that’s why we’re here to keep you in the know. Let’s explore more below!

What Is Perfection Of Transfer?

First up, comes the Perfection of Transfer. In simple terms, this document is required in cases where an Individual or Strata Title has NOT been previously issued for a property before a sale.

When a developer builds a new apartment complex or development, they own that property and the plot of land, under what is known as a Master Title.

Basically, this is the legal document setting out the ownership of the development and is issued during the building and construction phase.

All properties within the development are incorporated under the all-encompassing Master Title, until the respective Individual or Strata Titles have been issued.

The Perfection of Transfer comes into play under circumstances where a property purchase has been made, but before the Individual or Strata Title has been issued.

This means that when an Individual Title or Strata Title is issued later on, a Perfection of Transfer is required to transfer ownership.

That’s like dividing up the big development (under the Master Title) into smaller pieces that are individually covered by the other titles.

Imagine yourself taking your slice of the cake and then signing it with a flourish! (There’s no actual cake, sorry.)

There are potentially also cases where a Perfection of Transfer might be required when buying a property directly from another individual.

This could be because the seller originally purchased the property from a developer who had been slow in issuing the Master Title.

In the case of purchase directly from the developer, stamp duty payment can be deferred until the Payment of Transfer is completed.

With a direct purchase from a seller it must be paid at the time of a successful sale, and completion of the Sale and Purchase Agreement (SPA).

Basic Process of Perfection Of Transfer

Step 1: The purchaser pays the legal fees, stamp duty, and disbursements accordingly.

Step 2: Form 14A (Transfer of Ownership) is signed by the purchaser.

Step 3: Form 14A (Transfer of Ownership) is signed by the developer.

Step 4: Stamp duty is paid at LHDN.

Step 5: Registration is carried out at the Land Office

Step 6: The individual/strata title in the purchaser’s name is issued.

Step 2: Form 14A (Transfer of Ownership) is signed by the purchaser.

Step 3: Form 14A (Transfer of Ownership) is signed by the developer.

Step 4: Stamp duty is paid at LHDN.

Step 5: Registration is carried out at the Land Office

Step 6: The individual/strata title in the purchaser’s name is issued.

Documents Needed For The Perfection Of Transfer

- A copy of the purchaser’s identity card.

- A copy of the title.

- A copy of the SPA.

- The latest assessment receipt.

- The quit rent receipt.

- The assessment receipt.

- Other relevant documents.

How Perfection Of Transfer Is Calculated

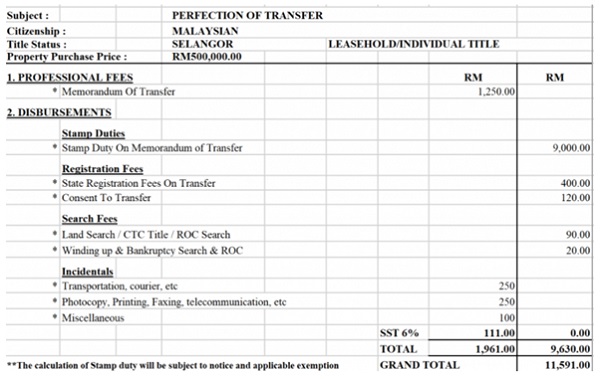

The quotation for a Perfection of Transfer includes an MOT’s professional lawyer’s fees, stamp duty, as well as disbursement fees.

These disbursement fees include those for registration, transportation, photocopies, consent to transfer, land and bankruptcy search, etc.

Most times, a significant amount comes from the stamp duty so if you’ve already paid for it at the time of signing the SPA, you can ignore it.

What Is The Perfection Of Charge?

The Perfection of Charge is another title transfer document, covering the transfer of ownership for an Individual or Strata Title, to the bank who supplied the home loan to purchase the property.

Despite what we like to think, a home loan essentially gives ownership of a property to the bank that financed it. We’re just sort of buying it back slowly, through regular repayments on that loan.

That means when a Perfection of Transfer is needed to take ownership from a developer or seller, a Perfection of Charge is required in order to then transfer that ownership onto the bank.

Basic Process of Perfection Of Charge

Step 1: Form 16A (Charge) is signed by the purchaser/borrower.

Step 2: Form 16A (Charge) is signed by the bank.

Step 3: The relevant documents are stamped at LHDN.

Step 4: Registration is carried out at the Land Office.

Step 5: The original title is forwarded to the bank.

Step 6: The client will receive a copy of the title and a copy of Form 16A.

Step 2: Form 16A (Charge) is signed by the bank.

Step 3: The relevant documents are stamped at LHDN.

Step 4: Registration is carried out at the Land Office.

Step 5: The original title is forwarded to the bank.

Step 6: The client will receive a copy of the title and a copy of Form 16A.

Documents Needed For The Perfection Of Charge

- A copy of the purchaser/borrower’s identity card.

- A copy of the title.

- A copy of the facilities agreement.

- The latest assessment receipt.

- The quit rent receipt.

- Other relevant documents.

How Perfection Of Charge Is Calculated

The quotation for a Perfection of Charge is calculated similarly to the Perfection of Transfer, except for the stamp duty that costs only RM40 for the relevant documents to be stamped.

What Are The Differences Between Perfection Of Transfer And Charge?

The Perfection of Transfer is required in all cases where a property title is transferred from under a Master Title to an Individual or Strata Title after a property purchase. It transfers ownership from the developer or previous owner to the new owner.

The Perfection of Charge is only required when a home loan has been used to finance a property purchase. It transfers ownership from the new owner to the bank that financed the loan.

Essentially, the Perfection of Transfer and Perfection of Charge refers to the transfer process of the name on the title from one party to the rightful owner. Here’s how to understand it better:

- Transferring the title from the developer -> You (the buyer) = Perfection of Transfer

- Transferring the title from you -> The bank (for financing) = Perfection of Charge

How Much Does It Cost To Transfer The Property Title?

Both the Perfection of Transfer and Charge are covered under a law called the ‘Solicitors Remuneration Order’.

This law governs the legal fees that lawyers can charge for facilitating property transactions, as well as a range of other financial agreements.

The Solicitors Remuneration Order was amended in 2017, and states clearly the scale of legal fees payable for completion of the Perfection of Transfer:

- If you use the same lawyer engaged for your property purchase during the SPA (where the SPA has been prepared but the strata title isn’t ready), Rule 2 of the Sixth Schedule states that the maximum charge is 25% of mandatory legal fees.

- If you use a new lawyer engaged specifically for the completion of Perfection of Transfer (where the SPA has been prepared and the strata title is issued at the same time), Rule 3 of the Sixth Schedule states that the maximum charge is 50% of mandatory legal fees.

We’ve outlined the mandatory legal fees scale below. Note that this is the maximum fee you would normally pay, and is subject to certain discounts.

Property Purchase Mandatory Legal Fees | |

Property Value |

Scale of Fee |

|

First RM500,000 (Subject to a minimum fee of RM500.00)

|

1%

|

|

For The Next RM500,000

|

0.8%

|

|

For The Next RM2,000,000

|

0.7%

|

|

For The Next RM2,000,000

|

0.6%

|

|

For The Next RM2,500,000

|

0.5%

|

|

For Excess Of RM7,500,000

|

Shall not 0.5% of the excess

|

To further understand the calculations and costs, let’s take for example, Owner A who purchased a condominium in Mont Kiara in 2020 for RM2,000,000. Here’s how much Owner A will need to pay for legal fees:

Legal fee calculation |

Amount |

|

First RM500,000 x 1%

|

RM5,000

|

|

Next RM500,000 x 0.8%

|

RM4,000

|

|

Next RM1,000,000 x 0.7%

|

RM7,000

|

|

Maximum legal fee

|

RM16,000

|

| Maximum POT legal fee with the original lawyer (25%) |

RM4,000

|

| Maximum POT legal fee with a new lawyer (50%) |

RM8,000

|

So for the Perfection of Transfer of Owner A’s RM2,000,000 home, they can expect to pay between RM20,000 to RM24,000, depending on whether they stick with their original lawyer or hire a new legal representative.

What Are The Legal Fee Waivers Applicable?

Did you know that there are certain waivers of the legal fees (read: a lower fee is charged) which you can enjoy?

Following what’s already stated in Order 6 of the Solicitors Remuneration Order 2005 (SRO), this is what is stated:

(a) a solicitor may give a discount of up to 25% on fees specified in the First and Third Schedule, except for any transaction governed by the Housing Development (Control and Licensing) Act 1966 [Act 118] or any subsidiary legislations made under the Act; and(b) no discount may be given on fees specified in the Second, Fourth, Fifth and Sixth Schedules. Therefore, subject to the discount permitted by Order 6(1) of the SRO, any device or method employed as a means to providing a discount (or which in effect provides a form of discount) is prohibited.

Basically, it means that lawyers are ONLY allowed to give discounts up to 25% under two circumstances:

- For the sales, purchases, or other forms of property transfer (the First Schedule)

- For the process to get back the property’s original title from the bank once the home loan is fully settled (the Third Schedule)

As for the Second, Fourth, Fifth and Sixth Schedules, those are NOT allowed for any discounts on the lawyer’s fees at all!

There are many other situations covered in the guideline, where the lawyer won’t be allowed to waive the fees, such as when he/she is in charge of both the SPA and the end financing (neither one will get a discount).

So, if you’re unsure about which cost you’ll be able to save some money on, it’s best to ask your lawyer to advise and explain to you!

What About Stamp Duty Under The Perfection Of Transfer?

That’s an excellent question! Stamp duty is an important consideration in Perfection of Transfer.

First up let’s be clear – you only have to pay stamp duty once on a property purchase. If you’ve paid stamp duty at the time of signing a SPA, you do not need to pay it at the time of completing a Perfection of Transfer.

Stamp duty is a tax based on a tiered value system, with a percentage owed for each level based on the value of the property. The tiers are as follows (with effect from 2019):

- 1% on the first RM100,000

- 2% from RM100,001 to RM500,000

- 3% from RM500,001 to RM1,000,000

- 4% for everything above RM1,000,000

Using Owner A’s RM2,000,000 home as an example, their payment for the stamp duty would be calculated like this:

Cost of Home |

RM2,000,000 |

|

1% on the first RM100,000

|

RM1,000

|

|

2% on the next RM400,000

|

RM8,000

|

|

3% on the next RM500,000

|

RM15,000

|

|

4% for above RM1,000,000

|

RM40,000

|

|

Total stamp duty fees

|

RM64,000

|

Remember to look out for those stamp duty exemptions too! That’s particularly important to consider for first-time buyers, who enjoy a number of stamp duty exemptions depending on the value of the property.

It’s also worth noting that if stamp duty charges have changed over the years and you’re not sure which to follow, it always goes back to the year you purchased the property.

Relevant Guide:

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.