Renting a property whether for your own stay or running a business is common in today’s world where many are not ready to purchase their own property yet.

While renting is much easier than buying a property, there are still many factors to look out for. This complete guide to renting both residential and commercial properties will cover:

- Deposits and recurring costs of renting a property

- How to identify a potential rental property

- Signing of the Tenancy Agreement

- Responsibilities of the tenant and landlord

Deposits And Recurring Costs

Deposits and recurring costs are the two main things that a renter has to be concerned about. Below are some of the biggest costs to consider when it comes to renting a property.

1. Upfront Costs

-

Earnest Deposit

Upon deciding on a property, the renter will need to pay an upfront amount of money to “book” the property. This is called an earnest deposit, and shows that you’re serious about renting the unit.

The earnest deposit is typically 2% of the total value of the property, or an amount equivalent to the first month’s rent. Once it’s paid, the landlord is not allowed to rent it to anyone else.

-

Security Deposit

A security deposit is to protect the unit’s owner against any damage caused by a renter.

In case there is any damage to the property, the unit owner has the right to deduct the cost of repairs from the security deposit when the tenant moves out.

Aside from that, the security deposit also protects unit owners from tenants who move out without notice.

Unlike the earnest deposit, you’ll need to shell out more for a security deposit as, well, it’s for security. The amount is usually set at the cost of two months’ rental.

The grace period for tenants to let landlords know they’re moving out is usually 2 months, but if the tenant moves out without giving notice, the landlord has the right to deduct the 2 months rental from the security deposit.

If you’ve been a good tenant with no outstanding payments and no damages done to the unit, you can expect a full return of the security deposit once your tenancy agreement has ended.

-

Utility Deposit

A utility deposit is usually collected when the tenant is in charge of paying the utility bills.

In case the tenant defaults on the utility bill payments, the landlord has the right to deduct the cost from the utility bill deposit. The utility bill deposit is usually 1 month of the unit’s rental.

Similar to the security deposit, if by the end of your tenancy agreement there are no pending utility fees, the utility deposit will be returned to you in full.

-

Purchase Of Furniture

Depending on whether the unit comes unfurnished, partially-furnished, or fully-furnished, a renter may have to set aside funds for furniture.

Fully-furnished units may come complete with everything you need including a study table and chairs, but if you need more than that or a bigger wardrobe, that needs to come out of your own pocket.

Unfurnished units are usually cheaper than fully-furnished units, so if staying long-term, it may be more cost effective for a renter to purchase their own furniture rather than renting a fully furnished unit.

2. Recurring Costs

The above are the upfront payments that need to be made, but what about recurring costs? These, on the other hand, are the costs that need to be borne periodically – mostly monthly.

-

Monthly Rental Payments

The most obvious recurring cost is the monthly rental, hence renters need to make sure that the rental fits their monthly budget.

Make sure you make these monthly payments on time every month, as you don’t want to get on your landlord’s bad side and have them looking for you, demanding their money!

PropertyGuru Tip

Set a monthly reminder on your phone or laptop to alert you when it’s time to make payment.

-

Utility Bills

Utility bills are another given should the tenant be in charge of paying the utility bills themselves.

The cost of this will not be known until the tenant moves in, but they can enquire the approximate cost from the landlord.

Most of the time, utility bills include electricity and water charges but there are landlords who waive one or the other. That doesn’t mean you should abuse it though as it’s not a very nice thing to do.

-

Parking Fee

Parking fees are usually only applicable in multi-unit or multi-storey buildings. If the unit does not come with its own parking lot, the tenant will need to come up with extra funds for it.

-

Unit’s Premises

The location of the unit will play an important role. If renting for own use, the unit should be close to the tenant’s place of work and perhaps places of education if there are school-going children.

If the unit is for a business, then the renter should look into the area’s accessibility via highways and maybe public transportation.

-

Tenancy Agreement Fees

These fees are usually applicable only to the rental of commercial properties as they require more formal rental documents.

The Tenancy Agreement is usually drafted by the landlord’s lawyers, and stated in the agreement will be the below:

- Who pays for the utility bills?

- What can the premises be used for?

- What are the penalties for damage to the property?

- How long will the contract last for?

- What are the landlord’s rights to inspect the property?

The Tenancy Agreement must be signed by both the landlord and tenant, and both copies must be stamped by the Inland Revenue Board of Malaysia (also known as LHDN) so that it can be legally used in court.

The Tenancy Agreement usually costs approximately 20% to 25% of the rental fees, and it includes the Stamp Duty fees and administration charges.

The Stamp Duty fees will be borne by the tenant and is calculated based on every RM250 of the annual rental amount.

Thankfully, the administration charges are much more straightforward and only charged once based on the monthly rental amount.

-

Guarantor fee

A guarantor may be occasionally required especially if the renter has a lack of credit history.

This would usually come into play for first-time renters, renters who have just moved to a different state, or if the renter doesn’t have a stable history of monthly repayments.

Find out what all these terms mean and learn more about Earnest Deposits, Tenancy Agreement fees, and utility bills in our comprehensive guide of Deposits and Recurring Costs of Renting a Property.

Check out properties for rent

Identify Potential Properties

Now that you understand the initial setup costs and recurring costs of rental properties, the next step is to identify potential properties to rent.

If you already know exactly what you want, using our listing pages to search for residential properties for rent or commercial properties for rent shortens the property hunt.

With those, property hunters will be able to enter the exact requirements of their ideal property, such as:

- Built-up area

- The number of bedrooms or bathrooms

- Tenure

- Furnishings (if any)

- Age of property/listing

Some factors that prospective renters should take into consideration during the search are:

1. Location

The location of a property is very important, whether for own stay or for business. Those looking for a home to stay in will want a premise that is close to their place of work, or their spouse’s place of work.

They should also be comfortable with the neighbourhood and its amenities, as well as preferably familiar with it.

Commercial property renters should, on the other hand, know whether their business depends on high traffic or is it a light industrial company that requires much transportation of goods.

The former should be in an area with high traffic, while the latter in a spot which has easy access to land, air, and sea transport.

2. Size

The size of a unit is also important. For example, renters with families will need bigger homes to accommodate all the members of the family.

You might be comfortable living in a studio apartment for now, but what if your family expands? It’s time to rethink your living quarters then.

For renters looking for a commercial property, they will need to know how much storage space they will need.

Would they need just a small office sufficient for 4 people to run their business from? Or would they require a large store room to store their goods?

It’s important to not only think of the now when renting, but the immediate future too.

If you have expansion plans up your sleeve, it might be better to rent a bigger space right away, than to start small and upgrade, with the risk of losing money throughout the move. Remember the unreturnable deposits?

3. Facilities

The facilities of a development are just as important when it comes to finding the ideal property to rent.

For example, a family with children may want to rent a property that has the convenience of a childcare centre and perhaps a swimming pool for their toddlers to learn swimming in.

However, a commercial property renter may want to look at the facilities of the garbage disposal system, and perhaps the security of the area.

It’s not just the property’s facilities that you have to take into account, but the facilities around you too.

This includes hospitals and clinics, police stations, schools, places of worship, industrial factories and warehouses, etc. You want a unit that’s as convenient as can be for you.

4. Safety

The safety of an area is non-negotiable when renting a property, as an unsafe area is not conducive for either work or own stay.

How do you determine if the location is safe or suitable enough?

You can do a quick search on the area’s crime rate and take a visit there yourself to see what it’s like, especially at night.

Keep an eye out for CCTVs, dark corners, and dangerous routes. If it sets off alarm bells in your head, it’s probably not the property for you.

5. Prestige

Depending on the tenant, the prestige of the area may or may not be of importance.

A business that wishes to give a good impression to their clients may want to search for a more prestigious address, while higher-ranking personnel looking for a home to rent may want a unit in a more prestigious area.

6. Lease Term

A lease term is the period that a renter is bound to, in order to rent the property.

After the lease ends, the landlord may choose not to extend the lease, and the renter will need to move out, or the landlord may choose to raise the rent.

There are cases though, where the landlord has decided to extend the lease term (on behalf of the tenant), so the tenant can continue to live there.

In a way, it’s a win-win situation for both parties as the tenant doesn’t need to find another unit and the landlord doesn’t need to find a new tenant.

This won’t apply for all rental properties though, as it requires mutual understanding, cooperation, and respect between both parties. Bonus points if you’re a really good tenant!

7. Call Up The Agents

After compiling a list of potential properties for rent, a renter should begin making appointments to view the units.

When visiting the units, property renters should probe about the history of the unit for additional information. Some of the things to ask are:

- How long has the unit been in the market?

- If it has been long, why hasn’t it been rented out yet?

- Are there any issues with the unit?

To find trusted and specialised property agents, renters can also visit the Find Agent page. Via this page, renters will be able to search for state-specialised agents who will have a better understanding of properties in that area.

Learn how to identify great properties for rental income by location, size, facilities, accessibility, safety, and lease terms with Features of a Good and Profitable Rental Property You Need to Know.

Arrange For Viewing Appointments

In order to not lose track of the essentials, property renters should bring a list of their criteria with them when visiting a property.

This will help them to keep track of what they truly need – a view that may get skewed after they visit too many units.

It’ll also help you stay on track, and not be distracted by that beautiful view and completely ignore the cracked walls and broken balcony railing!

A few questions that renters should ask their property agent are:

- What does the rent include?

- Are there additional bills? If yes, approximately how much will they cost. If you are sharing a unit, how will the bill be split?

- How much deposit is required, and how will the deposit be secured?

- What is the duration of the contract?

- Are pets allowed?

- Is there a parking lot included in the rental?

If you are renting a commercial property, these additional questions may come in handy:

- Will I need to pay any fees to set up the Tenancy Agreement?

- Is it a fixed term tenancy or a periodic tenancy?

- Will the unit be furnished? If yes, will it be partially or fully-furnished?

If the unit comes with electrical appliances, make sure to check that all of them are in working order.

This is to ensure that the landlord does not later put the blame on the renter for spoiling the appliances.

All the taps and showers should also be checked to ensure that they have a good flow of water. The same goes with power sockets; make sure all are fully functioning!

Signing The Agreement

Once you have found your ideal property, the next step would be to sign the tenancy agreement and pay the deposits.

As mentioned above, the deposits that need to be paid are the earnest deposit, security deposit, and utility deposit.

The earnest deposit is usually half a month’s rental, and the security deposit is two months’ rental.

The utility deposit is usually also 1 month’s rental, hence, a renter will in total need to come up with about 3 months of deposit when they first rent a property.

Signing The Tenancy Agreement

The signing of the Tenancy Agreement is usually not applicable to residential unit renters, as the documents that they need to sign are not so formal, if at all.

Commercial unit renters will, on the other hand, need to sign the Tenancy Agreement. To a commercial unit renter, a Tenancy Agreement is akin to a Sale and Purchase Agreement (SPA).

It is the document that will state all the terms and conditions for renting the properties, the responsibilities of the tenant to the landlord, and vice versa.

Among some of the things noted in the Tenancy Agreement will be the:

1. Names Of The Landlord And Tenant(s)

This is a very important section to get right in the Tenancy Agreement, as getting the name wrong will mean that the contract is void. Also, if the name is wrong, it will be hard to fight the case in court if there is any dispute.

The names in the agreement must be official as per the I.C. If you go by the name Samantha, but it doesn’t exist in your I.C., it can’t be included in the agreement.

2. Address Of The Property Which Is Being Let

This is also a very crucial part of the contract to get right, as getting the address of the property wrong may mean a long battle in court as there will be a dispute to the property being rented out.

The full address must include the unit name, street name, postcode, section and building name (if there is), and state.

3. Date Of The Tenancy’s Commencement And Duration Of Tenancy

The Tenancy Agreement will state the beginning of the contract, the duration, and the date the contract ends. During this period, the tenant will be bound by the terms and conditions of the contract.

At the end of the tenancy’s agreement, all terms will be void and if the renter wishes to extend it, an extension of the contract should be carried out or a new contract drawn up .

In foresight of that happening, the agreement will need to include clauses for renewing/extending the agreement.

4. Parts Of Property The Tenant Is Allowed To Use

In some cases, not the entire unit is being rented out, only a small part of it. If this is the case, then the Tenancy Agreement should state precisely which part of the property can be used by the renter.

The landlord will need to specify the type of property, and whether it’s the whole unit or just a room.

5. Rental And Bill Payments

The full monthly rental amount will be stated in the contract, as will the utility bills that the tenant will need to bear.

This section should also include the by-date the payment should be made, as well as any clauses if the payment is not made on time.

6. Services Provided

Should there be electrical appliances or any furniture in the unit, they will also be listed down in the contract, as well as the tenant’s responsibility over them.

The landlord will need to state the condition of the appliances/furniture too and when the renter inspects it, the condition should be exactly the same as written in the Tenancy Agreement.

7. Length Of Notice

In case that the renter decides to terminate the contract early, the penalty fees (if any) will be stated in the Tenancy Agreement.

All other terms of early termination of the contract will also be stated in this section. Ending the Tenancy Agreement early is also known as a Break Clause.

After ensuring that both parties agree to all the terms in the contract, both landlord and tenant will need to sign the contract.

The document will then be sent to the Inland Revenue Board of Malaysia, and the cost of the Stamp Duty is usually borne by the tenant unless otherwise agreed.

Learn more about important clauses that should be stated in the Tenancy Agreement when it comes to Signing Your Tenancy Agreement – What You Should Check before Signing.

Responsibilities Of The Landlord And Tenant

The relationship between a landlord and tenant only just begins when they sign the documents. Thereafter, each party is responsible for the other in different ways.

1. The Responsibilities Of A Tenant

A tenant should always honour the Tenancy Agreement. They should be responsible for the property they are renting, and treat it as their own. Here are some of the things that they should look out for.

-

Look After The Property

Looking after the property is an integral part of the contract. For residential and commercial properties, this means taking care to keep the unit clean and tidy, NOT by trashing it!

The property should be well-maintained at all time, both inside and out.

-

Take Care Of Provided Appliances

Some appliances may be included in a rented unit, whether they are air-conditioners or perhaps a refrigerator.

Whatever the electrical appliances put at the unit for the tenants usage, they should be used with care.

-

Do Not Make Changes To The Unit Without Permission

This is something that is usually stated in the contract, whether for residential or commercial units for rent.

For residential units, the landlords usually don’t allow for any permanent changes to the unit, such as repainting a room or perhaps nailing things to the wall.

For commercial units however, the only thing landlords don’t usually allow are renovations. Still, you should check with them if it’s alright to make any big changes to the unit.

In the event that renovations are necessary, the landlord should be informed and all renovations should be carried out with the landlord’s consent.

-

Contact Your Landlord In Case Of Spoiled Appliances

The appliances that are provided to the tenants may sometimes malfunction or spoil. In these cases, the landlord should be informed and the repairs should be carried out by the landlord.

In the event that the tenant feels that the time frame for the landlord to fix the appliance/machinery is too long, the landlord must be informed.

In addition, one would need to obtain the landlord’s permission if the tenant is able to hire their own repairman, and charge the bill to the landlord.

Want to know who has to settle the costs of a major repair if something unfortunate happens in the rental property? This is guide for you!

-

Familiarise Yourselves With The Appliances

Most of the time, the appliances provided may be complicated to use. If this is the case, always ask the landlord how to operate the machinery if you are unsure about it.

This is to avoid spoiling the machinery and risk things going from bad to WORST fast, unless you are ready to foot the bill!

-

Know Thy Neighbours And Be Considerate

Your neighbours can be your best friend or worse enemy. As a friend, they will be able to tell you if there is a break-in at your unit, or whether there might be an electrical or water shortage in the area.

As an enemy however, a bad neighbour can make life exceedingly and pettily miserable.

To keep your neighbours happy, be considerate. Keep your noise level to the minimum at night, do not hog space on their land, keep your surroundings clean, and so on.

2. The Responsibilities Of A Landlord

As the tenant is responsible to the landlord, the landlord is also responsible for its tenants.

The landlord’s job is not just to collect rent, but to ensure that everything in the unit is working at tip-top condition at all times.

-

Maintain Structure And Exterior Of The Property

While the tenants are expected to take care of the cleanliness and tidiness of the unit, it is the job of the landlord to ensure that the property’s structure and exterior are in great condition at all times.

This includes fixing leaking ceilings, cracking wall paint and mouldy walls. Some basic yard work might be included too, especially if the property has a garden that requires grass-cutting every few months.

-

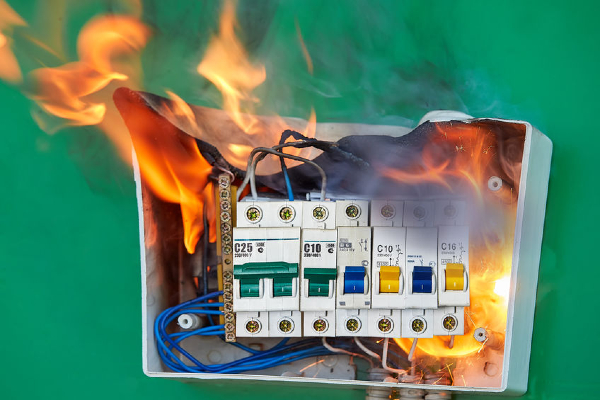

Insure The Building Against Fire And Floods

If the property is located on low ground, whether a commercial or residential property, the landlord should always buy insurance to cover the possibility of a flood.

The other type of insurance that should be obtained by a landlord for his/her property is the fire insurance. This will protect both the tenant and landlord should an emergency occur.

-

Deal With Issues Related To Water, Electricity And Gas Supplies

Should any issue arise in terms of utility bills, such as the internet not running smoothly or the electrical box’s metre reading going wrong, the landlord should always deal with the problem.

This is because the utility bills are ultimately tied to the landlord’s name, hence it would be easier for the landlord to settle any dispute.

-

Maintain The Appliances And Furniture

When a tenant informs the landlord about broken appliances, the landlord should get the appliances repaired as soon as possible.

This is to avoid inconveniencing the tenants, especially if it is a particularly essential piece of appliance such as a washing machine or refrigerator.

When sending a repairman over, the tenants should be given a minimum of 24 hours notice so they can be prepared. Nobody likes a stranger walking through their door unexpectedly!

-

Annual Gas Safety Check

If applicable, the gas supply in the unit should be checked periodically to avoid any accidents. This will ensure the safety of the tenant, and the safety of the landlord’s unit.

Renting can be less expensive and less hassle, compared to owning a home, but the place will never fully be yours to own.

There will always be some debatable points of the pros and cons of home ownership vs renting a place. Whatever you choose, make sure that it’s within your budget!

Relevant Guides:

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.