If you’re planning to buy a property, affordability could be a huge roadblock to owning your home in Malaysia.

While a bank loan is necessary (if you don’t have the entire sum in cash), you have an additional source of savings if you are a citizen or Permanent Resident in Malaysia!

That’s right, did you know about the EPF withdrawal for house purchase? You can tap into your Employees Provident Fund (EPF) for help, but only via Account 2.

Here’s how to use your EPF savings to help finance your home and pay the housing loan!

Step 1: Determine How Your EPF Money Will Be Used

Understanding Your EPF Funds

% of distribution from monthly contribution

70%

30%

Purpose

- Retirement savings

(Cannot be withdrawn before the age of 55)

- Financing a home

- Financing education (yours or your children’s)

- Medical expenses

The money you have in your EPF is divided into two. Account 1 is meant for your retirement, but you can use Account 2 for the purposes of funding your home.

Your Account 2 money can be withdrawn to:

- Purchase/build first (or second house; provided that the first house has been sold or disposed) house. To use Akaun 2 to purchase a property, you will need to show evidence that you have paid the booking fee and down payment for the property, together with the lawyer fee and stamp duty for the SPA.

- Reduce/redeem the housing loan for first or second house.

- Assist spouse to reduce/redeem his/her housing loan.

However, it’s very important to note that your EPF money cannot be withdrawn for use in a house renovation, as that’s not included in the list of withdrawal types!

Amount Allowed For Withdrawal

Housing Loan

(SPA Price – Loan amount) + (10% of SPA Price)

OR

All savings in Account 2

(whichever is lower)

(whichever is lower)

(SPA Price – Loan amount) + (10% of SPA Price)

OR

All savings in respective buyers’ Account 2

(whichever is lower)

(whichever is lower)

Self-financing

The purchase price with an additional 10% of the purchase price

OR

All savings in Account 2

(whichever is lower)

(whichever is lower)

The purchase price with an additional 10% of the purchase price

OR

All savings in respective buyers’ Account 2

(whichever is lower)

(whichever is lower)

Step 2: Check Your Eligibility

Wanna know whether you can do an EPF withdrawal? You are:

- A Malaysian Citizen; or

- A Malaysian Citizen who has made Leaving the Country Withdrawal before 1 August 1995 and has opted to re-contribute to the EPF; or

- A Non-Malaysian Citizen who:

- Has become an EPF member before 1 August 1998.

- Has obtained a Permanent Resident ("PR") status.

- You have not reached the age 55 at the time the EPF receives your application.

- You have a minimum savings balance of RM500.00 in your Account 2.

- Your property intended for purchase must be for residential purposes only.

- Your application must be made within 3 YEARS of signing the SPA.

- You’ve made a housing withdrawal before, or have made housing withdrawal before but already sold/disposed of the property.

- Your loan is approved from recognised lenders, or self-financed.

Step 3: Prepare Your Documents

- EPF withdrawal form [Form KWSP 9C(AHL)].

- The original copy of the Sale & Purchase Agreement (SPA).

- Photocopy of your Identification Card (myKad or Passport).

- A copy of the letter of loan approval from your end-financier.

- Bank account information, in the form of a passbook or a bank statement.

- Proof of relationship

- This is for joint purchases involving your spouse or next-of-kin, parents or siblings. For joint purchases involving next-of-kin, you are required to submit an explanation letter stating the reason for the joint purchase.

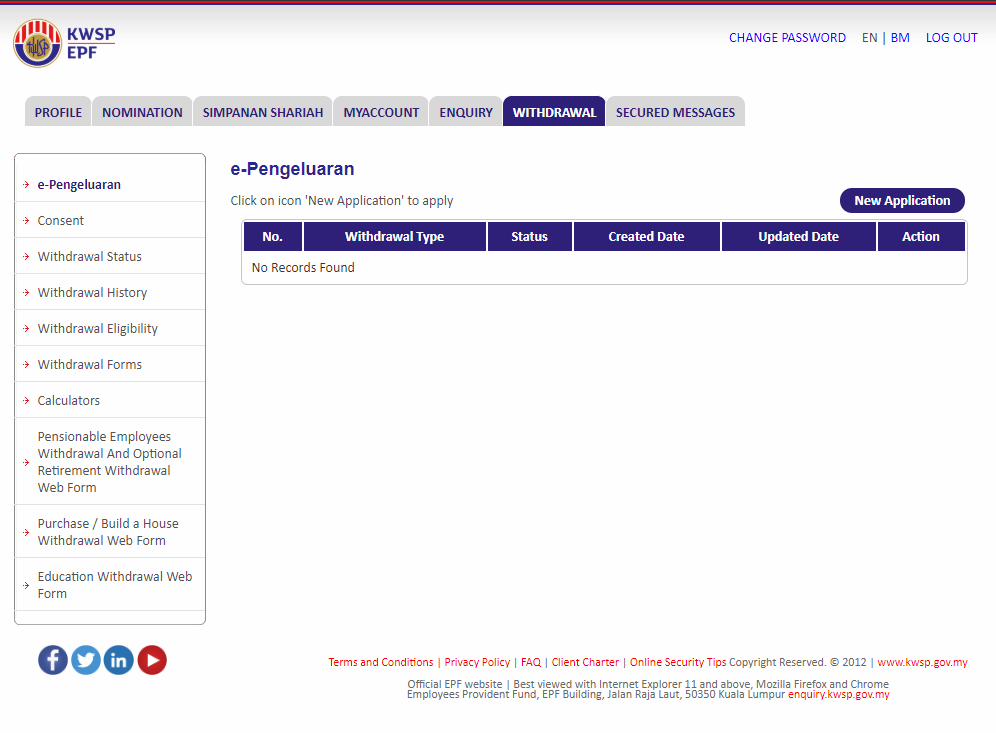

Step 4: Apply For Withdrawal Through i-Akaun

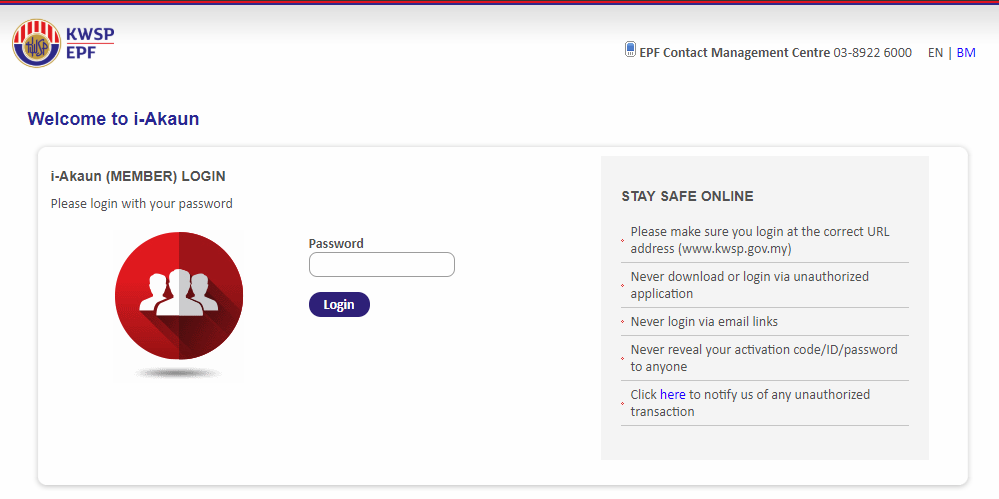

It is possible for you to apply for withdrawals online using your i-Akaun. If you have not registered yet, then follow these steps:

- Register for your i-Akaun at your nearest EPF kiosk or counter. You will be given a temporary username and password.

- Within 30 days, visit www.kwsp.gov.my. Click on the “Members Login” button on the top right.

- Under “User ID”, key in the username provided to you. Then click “Next”.

- Under “password”, key in the password provided to you. Then click “Next”.

- On the next screen, you will be shown the Terms & Conditions. Select “Agree” and click “Next”.

- The following screen entitled “i-Akaun Activation” is where you can enter your own password. For security purposes, you are also required to select an image and a secret phrase, both of which you should remember (This is to ensure that you are logging in to a correct website as opposed to a fake one mimicking the EPF website).

- Your i-Akaun is now ready. Once logged in, head to the “Withdrawals” page and click on “New Application” to start your application process.

What If You Don’t Have Enough Funds For The Down Payment?

As we mentioned above, you’ll need to show evidence that you’ve already paid the booking fee, down payment, and SPA fees for your property, BEFORE you can withdraw from your Akaun 2.

But what if you don’t have enough money for the down payment?

While most properties require a 10% down payment, here are other ways you can navigate that with some assistance:

1) My First Home Scheme (Skim Rumah Pertamaku)

Up to 110% financing for eligible first-time homebuyers. Find out everything you need to know on the My First Home Scheme here.

2) BSN Youth Housing Scheme

Affordable housing scheme by Bank Simpanan Nasional for eligible first-time homebuyers. This scheme has been extended until 31 December 2021, here’s all you need to know about it.

3) Rumah Selangorku 2.0

Affordable housing scheme for eligible first-time homebuyers in Selangor only. Find out all the important details about Rumah Selangorku here.

Other Ways You Can Use Your Akaun 2 For Property-Related Matters

1) Pay Home Loan Monthly Instalment

You can also arrange for the money in your Akaun 2 to be used to pay for your housing loan on a monthly basis.

This can either be done as standing instructions directly paid to the lending bank, or credited into your personal account.

You just need to submit your latest housing loan balance form to KWSP along with other supporting documents. The only catch is that you can only cancel these automatic payments after 1 year.

2)

This is useful if you need to show your lending bank evidence of a higher income, so that you can qualify for a higher property loan.

Under its Flexible Housing Withdrawal facility, you can apply to EPF to set aside a certain amount of money from your monthly contributions into a special Flexible Housing Withdrawal Account.

These contributions are treated as your income, and can help you qualify for a higher loan amount.

For further enquiries or additional information, contact:

- Any nearest EPF Office;

- EPF Contact Management Centre (CMC) at: 03-89226000

- Customer Feedback: http://enquiry.kwsp.gov.my

Relevant Guides:

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.