While it’s not a topic that most enjoy talking about, it’s always best to get a will sorted out as early as possible.

After all, you don’t want to leave something as important as that till it’s too late. In this article, we take a look at why wills are important and how they work in Malaysia.

Why Is A Will Important?

A will is important because it covers is how your assets get distributed. Many dramas have started because of family members fighting over an inheritance.

If you pass away without a will, all of your assets will be distributed according to the Distribution Act 1958. Your wishes or needs of your family members will not be considered!

It could also take quite some time for your assets to be distributed – up to five years. This may pose an issue if you’re the sole breadwinner of your family, or have dependents.

Furthermore, there’s also the chance that your assets might depreciate in the time it takes for your will to be executed.

By having a will, your family members will know how much you have, and where to find it.

You’ll also save them a lot of headache from administering your estate, and dealing with any complications that may arise from that.

The Wills Act: How Wills Work In Malaysia

The Wills Act in Malaysia is applicable only to non-Muslims as Muslim inheritance is governed under the Syariah law.

A Muslim would need to prepare a “Wasiat” (which is the equivalent of a will), and appoint their “Wasi” (the equivalent of an executor).

What Makes A Will Valid Then?

Under the Wills Act in Malaysia, for your will to be valid, you’ll need to:

- Be at least 18 years of age at the time of writing.

- Be of sound mind.

- Have the will in writing and signed.

You’ll also need to have at least two witnesses, who will sign on your will as well. All parties must be present during this signing.

Your will is valid until it’s replaced by a new one, revoked in writing, or intentionally destroyed. However, it’s automatically revoked if you get married (or remarry), or convert to Islam.

Note that a beneficiary cannot be a witness. If you appoint someone to be a witness to your will, they can’t be a beneficiary of that will. So do take note of this when you appoint witnesses!

What Is An Executor And What Is His/Her Role?

The executor’s role is to ensure that whatever is written in your will is carried out accordingly. He or she will need to do the following:

- Locate your will.

- Apply to the court for a grant of Probate – When a person is granted the grant of Probate, he or she is allowed to administer the assets of the deceased.

- Call in your assets.

- Pay off your liabilities.

- Distribute your assets as per your will.

- Prepare a statement of account.

When your executor takes charge of your assets, he/she also assumes the role of trustee, and will hold your assets on trust for your beneficiaries until the distribution is completed.

A trustee will also take on responsibilities imposed by the Trustee Act 1949. An executor is also entitled to deduct expenses incurred from administering your estate, within reason.

Time To Appoint Your Executor(s)!

According to the Wills Act in Malaysia, you can appoint anyone who is 18 years of age or older to act as your executor and trustee, with up to four executors.

You can also name people to replace any of your executors should they predecease you, or renounce their executorship.

A beneficiary can also be an executor. For example, if you are willing everything for your spouse, then it would be a good choice to appoint him or her as the executor.

Before you appoint someone, it’s best to inform them and get their consent first – you don’t want to appoint someone and have them renounce it later!

Alternatively, you can also appoint a trust company. The decision on who to appoint depends on the size of your estate, and how complex your will is.

A friend or relative may not have the necessary knowledge to administer your estate properly, and in this scenario, a trust company might be a better choice.

What Are The Will Executor Fees In Malaysia?

From the executor’s point of view, that’s quite a lot of responsibility on your hands. Dealing with relatives is no easy feat, especially in the wake of a loved one’s death.

Will executor fees are paid to your executor as compensation for holding the liability, and doing the dirty work of ensuring your estate is distributed as you meant for it to be distributed in your will.

If you’re appointing a trust company, the fees are straightforward and will already be set prior. This is typically 1% of the estate.

But what if the executor is one of your beneficiaries such as your sibling or a distant relative?

Keep in mind that there is no provision which states the executor must be entitled to a certain fee. In these instances, it’s entirely up to your discretion on how much you want to compensate the executor.

Does A Will Need To Be Stamped In Malaysia?

No, a will does not need to be stamped in Malaysia for it to be legally recognised.

Who Can I Ask To Write My Will?

It’s worth noting that not every lawyer will know how to draft a proper will. While they all have the legal capacity to help you draft it, not all of them will have the requisite expertise.

Lawyers have specialisations too – for example, a lawyer who deals mostly in business issues wouldn’t know as much about wills.

If you plan to hire a lawyer to write your will, look for one who specializes in that field. Bear in mind that this can be quite costly.

If you have relatively simple requirements for your will and no complicated family situations, you can get your will sorted at a bank, or with a will-writing service provider.

Some major banks have their own will-writing services, and these start from a few hundred Ringgit per will.

Is There A Cost To Write A Will In Malaysia?

If you’re employing a third party to write your will for you instead of going the DIY route, you can expect the costs to range from a few hundred up to a few thousand. Of course, this depends on the third party involved – whether it’s a will writing provider, trust company, legal firm or lawyer.

If the distributions are lengthy and complicated, or there is a larger estate involved, this may also ramp up the price accordingly.

Also note that aside from the fees for will writing alone, many companies may also charge you for custodianship of the will, as well as its execution.

Can I Write My Own Will In Malaysia? How?

Yes, you can write your own will! A will is valid as long as it fulfils the criteria stated earlier in this article. Hence, you don’t actually have to pay a few hundred ringgit to a lawyer or trust company to get the job done.

Of course, it comes with its drawbacks as well.

DIY-ing a will may risk invalidation of your will due to possible missteps in the process. If there are a lot of beneficiaries and estate involved, it can be quite a complicated process, too, in which a DIY may not state the terms clearly enough.

Lawyers and trust companies are in a much better position to prevent the many complications that could go wrong.

If you plan to draft up your own will, you will need to make sure it fulfils the validity criteria as we mentioned earlier. Wills typically are written in accordance to standard sections and templates, so to write your own will, you can use the templates as a guideline (available below).

Your DIY will is only valid if:

- You are at least 18 years of age at the time of writing

- Are of sound mind

- Have the will in writing, signed and dated

- Have two witnesses present to sign your will

- Witnesses must not be a beneficiary

Most importantly, be as specific as possible!

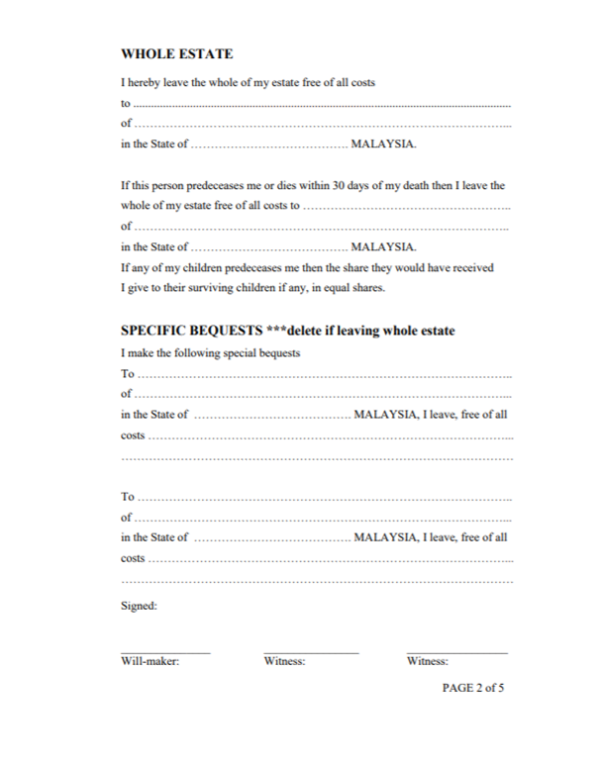

Example Template Of A Will In Malaysia

If you do opt to write your own will, there are plenty of sample templates available online which can then be tweaked according to your needs.

Below is an example template of a will which is made available in The Original Malaysian Legal Will Kit by Kenneth Khoo, advocate and solicitor of the High Court of Malaya.

Basic Contents Of A Will In Malaysia

On top of referring to multiple samples of wills in Malaysia, you should also be aware of the basic contents your will should include.

|

Basic information of testator

|

|

|

Basic information of witnesses

|

|

|

Clauses

|

|

Can I Revoke My Own Will In Malaysia? How?

You can always revoke your own will as and when you wish. Any new will written will automatically revoke the earlier one written.

But say you hired a lawyer to write your will for you while you were in your first marriage. A few years later, you divorce your husband/wife and want to remove him/her as your beneficiary. Is your previous will still valid, or will it automatically be revoked?

As divorce does not automatically revoke your will, you will have to write a new one, which will take precedence and invalidate the previous will.

Below are the circumstances in which a will can be automatically revoked.

- Marriage or remarriage, unless the will is made “in contemplation of a particular marriage”. Divorce does not automatically revoke a will.

- If the will was physically destroyed by you with the intention to revoke it. Accidental or malicious destruction by a third party will not revoke a will.

- A subsequent will written after the previous will render it invalid. You can also make a written statement in the presence of 2 witnesses to revoke it without writing a new will.

- A non-Muslim person who converts to Islam will revoke his/her will. This is because estate distribution will automatically follow the Faraid distribution.

What Happens If A Person Passes Away Without A Will?

A person who passes away without a will (intestate) will have his or her estate distributed according to the Distribution Act 1958.

However, this act doesn’t apply if he or she is a Muslim in West Malaysia and Sarawak, or is a native of Sarawak. The same goes for Sabah, where the Intestate Succession Ordinance 1960 applies instead.

If you’re already picturing family members squabbling for your property, know that the Act will distribute your property in a fair manner according to certain percentages.

Below are the distributions of property if someone were to pass away without a will according to Section 6 of the Distribution Act 1968.

Parents, issue and spouse

1/4

1/4

1/2

Spouse and issue, but no parents

n/a

1/3

2/3

Parents and issue, but no spouse

1/3

n/a

2/3

Parents and spouse, but no issue

1/2

1/2

n/a

Parents only, no spouse nor issue

Whole estate

n/a

n/a

Spouse only, no parents nor issue

n/a

Whole estate

n/a

Issue only, no spouse nor parents

n/a

n/a

Whole estate

| Remaining Family |

| No parents, spouse nor issue (prioritised by number) 1. Brothers and sisters 2. Grandparents 3. Uncles and aunts 4. great grandparents 5. Great granduncles and grandaunts 6. The government |

What Happens If The Beneficiary Dies During The Will Maker’s Lifetime?

As the beneficiaries usually include one’s children, it’s expected that they should live longer than the will maker. But what if that isn’t the case?

According to Section 19 of the Wills Act 1959, if a beneficiary passes away during the will maker’s lifetime, the portion of the estate meant for him/her will be voided by reason of death.

It will then be included as part of the “residuary estate” and distributed according to the residuary estate clause.

No matter how thorough and detailed you are in how your estate should be distributed, there are bound to be certain details left out.

In such cases, they are dealt with according to your instructions in your residuary estate clause. Think of this clause as your catch-all safety net!

However, the case may be different if the beneficiary was the child or issue of the willmaker, in which case the supposed estate will be inherited by the beneficiary’s issues instead.

What Happens If The Beneficiary Dies After The Will Maker’s Death, But Before The Will Was Executed?

Execution of a will can take a long, long time. Within that span of time, a lot can happen – including the death of a beneficiary.

In such cases, the estate due for the beneficiary will still be passed on to the deceased beneficiary, to then form a part of his/her estate.

From there, it will be dealt with according to the deceased beneficiary’s will.

Having a rock-solid will is fine as long as there are no other complications within the family, such as the child’s birth. But if the child was born out of wedlock, find out if he/she would still be allowed to inherit a property.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.