“It’s all about the money!” Investment of any form is about profit and stability. By investing, we are all looking for high returns, with reasonable risks, reliability, and certainty.

Property or real estate investment has been one of the most popular and profitable options for a long time. Ask any baby boomer or Gen X, their first advice for investment will be: “Buy property and rent it out”!

A property investment’s profit involves rental return or capital appreciation, depending on the prospect of the portfolio, and what type of an investor you are.

The most common types of property investors are those who are either in it for the long-term or short-term return.

To get the desired Return on Investment (ROI), you must choose your property with the right price, location, type of property and the time-frame you would want to see some capital appreciation or profit.

How Is The Property Market Today?

Daniele Gambero, chief executive officer of REI Group of Companies, said that Malaysia still has an abundant and healthy demand for residential properties priced between RM300,000 to RM700,000.

“The latest analysis done on datasets in 2020 are showing a shortfall of 500,000 dwellings in 2021, and predictive analysis are saying that this number will be still there in 2025,” he said.

With our population currently on a positive growth rate and plenty of young Malaysians moving from rural areas to more urbanised areas, Gambero opined that the secondary market will see a new acceleration due to a change of lifestyle with WFH that has become part of the new norm

Also, it could unfortunately be due to the possible incoming wave of “owners urgently selling” (brought about by job cuts or lack of business), which might start appearing soon.

He said all in all, this year might remain on a neutral trend, with interesting happenings being prepared for 2022.

With the uncertainties in property investment in the current market, it is not surprising that investors are always looking for alternative types of investment for their portfolio.

If you are a prospective investor and are not sure about property investment as it requires a certain level of affordability and knowledge on capital appreciation, you can always opt for Real Estate Investment Trusts (REITs)!

Avid investors should already know about REITs, which has been quite vigorous for the past decade, and it is becoming a more popular option amongst youngsters and newbie investors.

What Is REITs?

REITs is an investment type where it pools the capital from numerous investors to create a single investment fund for real estate ventures, with a diversified portfolio that includes residential, retail, office, hospitality and medical.

It first started off as “property trust” in 1989, and was rebranded in 2004.

The current version follows Securities Commission Malaysia’s Guidelines on Real Estate Investment Trusts (REITs), which was designed to provide a legal framework for better monitoring of the newly introduced REITs.

It must also comply with the requirements by the Securities Commission Act 1993, for listing on Bursa Malaysia.

The key components that form the structure of a Malaysian REITs (M-REITs) are:

- The deed

- The assets of the REIT

- The trustee

- The management companies

- The unit holders

To make it easier to understand, it will be like buying shares of a company that owns and manages real estate.

REITs provides a way to invest in quality large-scale commercial real estate, without having to buy the properties directly, and offers a stable income stream.

How Is M-REITs Doing In The Current Market?

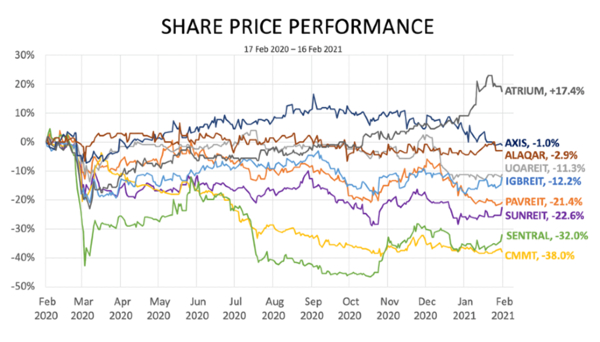

It goes without saying that the property market has been challenging in recent years, more so with the global COVID-19 pandemic and the hard-hitting impacts.

According to Dato’ Jeffrey Ng Tiong Lip, immediate past chairman of Malaysian REIT Managers Association (MRMA) and chief executive officer of Sunway REIT Management Sdn Bhd, M-REITs has not been spared.

It has been impacted by the movement restrictions and economic downturn amidst the COVID-19 pandemic, particularly the retail and hospitality-focused REITs, which are dependent on consumer and tourist spending.

“M-REITs that were focused on the office and education sectors have remained relatively stable, although the increased adoption of Work-From-Home (WFH) and e-learning would require longer-term adaptation and innovation.

"Meanwhile, the growth of technology and e-commerce boom has sustained demand for industrial and healthcare-focused M-REITs, which continue to see resiliency in their performance during the pandemic,” Tiong said.

Leong Kit May, chief executive officer of Axis-REIT, said the market is currently ‘cautiously optimistic’: “As the government steps up its vaccine rollout, we anticipate the economy will recover in tandem with the less restrictive SOPs as the country reaches herd immunity,” she said.

She noted that a number of analysts have maintained their ‘overweight’ ratings on MREITs – supported by the low-interest rate environment, they expect the MREITs to deliver solid earnings after 2021, as earnings normalise post-pandemic.

PropertyGuru Tip

The term ‘overweight’ here basically refers to the fact that analysts actually believe that a company’s stock price should perform better in the future.

As for Axis-REIT, she said, the impact of the pandemic on the industrial properties is manageable as most of its tenants are still operating especially logistics and manufacturing. As of March 2021, 92% of Axis-REIT’s properties are under industrial titles.

“Besides that, the demand for industrial properties is still high, in particular for logistics and warehousing, as a result of the booming of e-commerce,” Leong said.

According to The Fifth Person, a portal that’s dedicated to spreading the importance of financial literacy and sound investment knowledge, there are still a lot of M-REITs with a bulk of their assets concentrated in retail which have not done well.

Why Choose REITs?

Before investing in REITs, you have to know and analyse the benefits of it, in order to recognise if it is the right type of investment for you. So, what are some of the benefits of investing in listed REITs?

1) Affordability

The cost of investing in REITs is just a fraction of the cost of a regular property investment.

2) Liquidity

REITs are more liquid compared to physical properties. Units of listed REITs can be readily converted to cash, as they are traded on the stock exchange.

3) Stable income stream

REITs tend to pay out steady incomes (similar to dividends), which are derived from existing rents paid by tenants who occupy the REITs’ properties.

4) Exposure to large-scale real estate

You can derive the benefits of the real estate on a pro-rated basis through a REIT, a quality investment which is affordable.

5) Professional management

You benefit from having the REIT and its underlying assets managed by professionals who will add value for a higher yield.

REITs Vs Property Investment

With just a glance, you will know that although both the conventional investment and M-REITs are in the same industry, the differences are quite clear for you to distinguish before deciding.

Gambero is of the opinion where, considering the current market situation, REITs allows for an easy ‘exit strategy’, for those in need of obtaining cash fast.

“Property, when compared to REITs, carries the risk of long waiting times and many procedures, which might not be in favour of those who are cash-strapped,” he said.

He also stated that while REITs has a market value which allows the seller to know precisely how much it will give them and decide whether to proceed or not, an urgent need to dispose of a property might force the seller to drop to a below-market price to speed up the sale.

Leong said the key difference is that investors can own commercial real estate, without the hassle of managing the property if they choose to invest in REITs.

“REITs, through experienced management teams, purchase and manage commercial real estate. When you purchase shares in a REIT, you become a partial owner of those properties.

"From this perspective, you are also a partial owner of an operating business that manages properties for a profit. This makes it possible for investors to earn dividends from real estate investments – without having to put in huge capital to buy, manage or finance any properties themselves.”

For the individual investor, she said, it all depends on the capital which one has, as well as his/her risk appetite.

Investing in properties directly would require a higher capital commitment, and is illiquid, as opposed to investing in REITs.

Concurring to that, Dato’ Ng also said the main difference which separates REITs from conventional property investment, is having a professional REIT Manager team appointed to manage the assets on behalf of the investors.

They will ensure all aspects of ownership, leasing and management are well taken care of – from acquisitions and maintenance, to payments of insurance, quit rent, and assessments.

This also involves strategic asset enhancement initiatives to upkeep and enhance property values for long-term portfolio growth.

“The asset types are also different, with REITs having a majority of its portfolio in prime and diversified commercial properties, as compared to conventional property investments, where most investors have their investments concentrated into a single or a few residential properties.

“REITs offer exposure in different geographical markets and property segments, allowing investors to easily diversify their portfolio’s risk exposures,” he said.

Affordability to start investing in REITs or conventional property also play a key role in determining the investment choices.

“To invest in REITs, prospective investors can start with a small investment of a few hundred or a few thousand Ringgit, compared to property investment which may require heavy upfront capital commitments,” Ng stated.

Investors must also understand the liquidity aspect of the different types of investments. The real estate market generally requires a longer duration to complete a transaction.

Whereas M-REITs, which are listed on the local bourse, allowing investors to partially or fully cash out of their investments, or reinvest their returns for long-term compounding.

In the end, Ng said, both REITs and conventional property investments offer different benefits to investors in the current market environment.

After suffering correction in M-REITs unit prices over the past year, one can capitalise on the opportunity of buying into some of the M-REITs at below its Net Asset Value (NAV) for future upside once the pandemic is over, while also reaping its steady distribution income.

Capital

Lower capital – can start investing with as low as RM1,000

Heavy upfront capital commitments

Management

Managed by experts

Mostly self-managed

Ownership

Only shares

Owner of a property

Dividend/Rental

Dividend yield at around 5-7%

Rental yield at around 3-5%

Transaction Cost

Low transaction costs, doesn’t take up time

High transaction costs, time consuming

Diversification

Highly diversified

Very little chance to diversify

Liquidity/Trade

Easier to buy and sell

More processes to buy and sell

How To Invest In REITs?

Experts have opined that with the price correction of M-REITs and the property market, this is an attractive time for prospective investors to consider looking for bargains, especially those who are looking to have their first investment in the real estate market.

There are a few areas that investors should look into, before investing in REITs (apart from the yield), such as:

- Ability to grow

- Type of assets

- Weighted average lease expiry

- Ability to renew the tenancy and ease of getting a new one

- Rental reversion

- Its balance sheet and cash flow

According to Bursa Malaysia, M-REITs, just like stocks, are subject to the same trading, payment, and settlement rules.

To start investing, you need to open a Central Depository System (CDS) account and a trading account with a participating organisation.

You can buy the M-REITs share of any entity in Malaysia through Bursa Malaysia, just like you would in a stock market investment.

You can also get consultation from experienced brokers on the ‘what’ and ‘where’ of the current market. You can refer to listings of M-REITs that are available online.

Dato’ Ng said that for REITs, due to its disclosure requirements, prospective investors can easily obtain the information on the properties owned, as well as its financial performance via the annual report of the REIT.

To Choose REITs, Or To Choose Real Property?

The current situation is a blessing in disguise, as the price correction of the M-REITs and current property market condition makes this an attractive time for prospective investors who are looking for bargains, especially those who seek their first investment in the real estate market.

The important point to remember here is, regardless which type of investment you choose, you HAVE to do thorough research and SHOULD NEVER end up spending more than your budget!

Relevant Guides:

-

The Complete Guide To Property Investment In Malaysia

-

50 Property Investment Terms For Understanding Investment Better!

-

5 Types Of Property Investment In Malaysia, And How To Earn From Them

-

Finding Low-Entry, High Yield Properties In Malaysia For A Positive Cashflow

Keep Track of New Launches

Visit our new launches page to find the new launch project of your dreams and submit an enquiry today.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.