How do you make the right choice when buying a property? For many, we’re afraid to make the wrong choice because hey, it is a big amount of money and it’s one you’ll have to stick with for the rest of your life.

Because it’s such a big and expensive decision, buying a property is something you have to consider very carefully. The pricier — but bigger!— the property might sound like a dream, but is it the right one for you?

Buy What You Can Afford Now, Not Later

Life is ever-changing, and your finances might improve in the future or it can go south. If you insist on buying a property, prioritise affordable properties that fulfil your essential needs, even if it means settling for something smaller.

Let’s do a quick comparison of what’s affordable, by using a gross monthly income of RM6,000 as a constant variable.

As your income will affect your mortgage loan amount, let’s park it at an estimated RM3,000 leftover per month after loans and necessities.

Property A

- Cost of purchasing a 2R1B unit in 2021: RM300,000

- 90% loan repayment at 3.30% interest rate: RM270,000

- Monthly mortgage repayment: RM1,182 per month

Property B

- Cost of purchasing a 3+1R2B unit in 2021: RM600,000

- 90% loan repayment at 3.30% interest rate: RM540,000

- Monthly mortgage repayment: RM2,365 per month

You’d be utilising the leftover RM3,000 for your monthly repayment, so purchasing property A would leave you an excess of RM1,818 per month, whereas property B would grant you RM635 monthly.

“Why should I choose a smaller property when I can buy a bigger and better property instead? I know I’ll get a pay raise, so I can definitely afford it!”

We don’t mean to be a wet blanket, but how confirmed is that pay raise? Unless you’re the boss of your own company with complete control over finances, just like any other employee, you’ll be waiting for your monthly paycheck.

A fancy home might make everyone green with envy, but if you’re lighting candles at night to save on your utility bills, you’ve trapped yourself in a vicious cycle of materialistic greed.

However, buying an affordable property doesn’t mean settling for the cheapest option! Choose a property that’s right for you with the criteria you prefer, like the location, amenities, and comfort for all the occupants.

An Affordable Property Is Stil An Investment

How is an affordable property considered an investment, especially one that’s not in a good location/neighbourhood, or is too small for anyone to live in? Well, it lies in the money saved, and not the physical attributes of the property.

Referring to the examples of property A and property B, a lower monthly mortgage means more money that you can set aside for yourself or investments — treat yourself to a nice dinner, or expand your investment portfolio!

When you buy a home that’s beyond your affordability, you’ll be busy spending on it and its maintenance, rendering your potential for investment to a limited scope. The less you spend, the more you have.

If you’re the type who likes to save for a rainy day, the amount saved would be substantial enough for emergencies, and BONUS! You can retire early or live in the lap of luxury for your retirement.

What Is The 3-3-5 Rule In Property?

Aside from the basic costs of buying a property, are there alternatives to calculate the ideal amount you should spend on property? It’s a good thing you asked, because yes, there is!

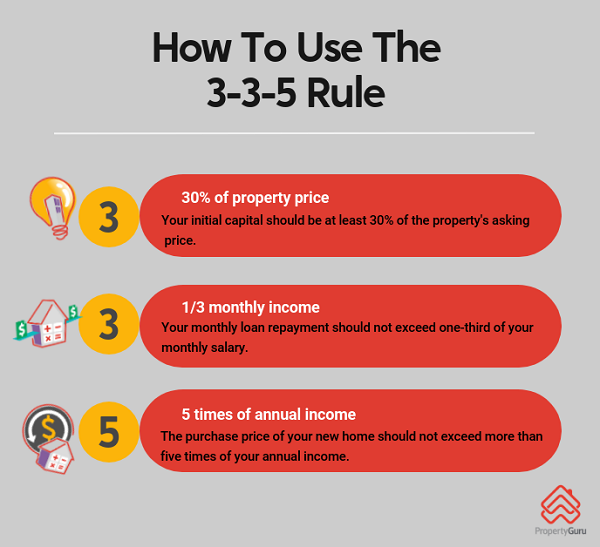

One method is the popular 3-3-5 rule that’s a Singaporean favourite, and it’s even endorsed by the CPF board (their version of our EPF!).

The 3-3-5 rule is a guideline for new buyers to take into consideration before purchasing their first property.

- 3 — You should have a capital of at least 30% of the property’s asking price.

- 3 — You should not spend more than ⅓ of your monthly wages on your monthly mortgage repayment.

- 5 — The price tag of the property should not be more than 5 times your annual income.

How To Calculate Your Housing Affordability With The 3-3-5 Rule?

You can easily figure out your housing affordability with the 3-3-5 rule, and you can do it right now! The only figures you need to know are your monthly income, annual income and amount of savings. Check out the image below for an example.

How Does The 3-3-5 Rule Work To Determine Your Housing Affordability?

The 3-3-5 rule serves as a guideline to make sure you’re not overspending on your property. Oftentimes, we tend to overestimate our spending capabilities, which is where this rule steps in.

Sometimes, buyers focus on making sure they have enough money in the bank for the down payment and upfront costs, but neglect to analyse their affordability in the long-term.

The 3-3-5 rule is a good rule of thumb to make sure you can afford your property from all aspects, as can be seen:

- Rule 1 ensures you have enough savings to cover the upfront costs.

- Rule 2 ensures your monthly instalment is proportionate to your monthly paycheck.

- Rule 3 looks at the big picture, ensuring the property’s overall price isn’t out of your means.

Bear in mind that the 3-3-5 rule is a guideline and not something to be taken too literally. For instance, if you’ve got significantly more financial responsibilities, you may want to focus your efforts on increasing your income or lowering down the percentages first.

Example Of Housing Affordability Calculation

Let’s bring this rule to life with an example, shall we?

Marcus and Marie are newlyweds looking to purchase their first home. Their combined monthly salary is RM 12,000 and together, they have RM150,000 in savings. What is the maximum property price they can afford?

Rule |

Calculation |

|

Rule 1 – 30% of property price

|

RM150,000 / 0.3 = RM500,000

|

|

Rule 2 – ⅓ of monthly salary

|

RM12,000 / 3 = RM4,000

|

|

Rule 3 – 5 times of annual income

|

RM12,000 x 12 x 5 = RM720,000

|

According to Rule 3, Marcus and Marie can afford a house worth RM720,000. Rule 1 on the other hand, says the maximum price tag should be RM500,000.

This is because, in comparison to their monthly salary, they’re lacking in savings, which may make affording all the upfront costs tough.

From here, they simply have to wait it out. After a couple months of growing their savings pile, they should be able to afford a home worth about RM720,000.

They can also opt to make less down payment upfront, though it’s always recommended to pay more from the get-go so that you pay less interest.

Does The Pandemic Affect Your Housing Affordability?

According to the PropertyGuru Malaysia Property Market Index Q3 2021 report, the overall asking prices for the entire country has remained relatively stable in Q2 2021 despite the various lockdowns.

But with wave after wave of job cuts, many Malaysians who might have been keen to purchase the home they’ve been eyeing on find themselves robbed of the ability to do so.

During this time, banks are also more stringent with loan applications to minimise risk of defaulters when interest rates rise again in the future.

Of course, if your finances are strong and stable enough to consider a penthouse suite in the Kuala Lumpur city centre, go ahead! Purchasing a property is not just about the monetary aspects, but also a future goal for not just you, but your loved ones too.

As everybody has different perspectives on money and investment, there’s no ‘one property rule’ to rule them all.

Despite that, we hope you make the right decision when purchasing a property and if not, look on the bright side and appreciate what’s here and now, whilst working towards the future!

Relevant Guides:

-

Here Are 10 Trends You Should Give Up To Afford A Down Payment!

-

SPA, Stamp Duty Malaysia, And Legal Fees For Property Purchase

-

How Much Home Loan Can You Get Based On Your Salary In Malaysia?

Keep Track of New Launches

Visit our new launches page to find the new launch project of your dreams and submit an enquiry today.

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.