We are all well aware about the procedures that we need to follow, and the documents to be submitted, before owning a home.

However, not many are aware of the procedures when it comes to wanting to transfer the property title or ownership to someone else.

Wouldn’t you want your hard-earned assets to be passed on to the rightful family members, and most definitely not fall into the wrong hands?

Now, to avoid matters becoming complicated, here are some of the common FAQs related to property title transfers, so that you can be aware of them and avoid falling into the same trap!

What Is A Property Title Transfer?

First off, a property title transfer is the process of changing the ownership of a home to someone else, legally.

You have to understand that property title transfers are not only done when you are purchasing a property, it is also required for circumstances like death, separation, divorce, inheritance, gifting, or when an owner is unable to pay the home loan.

FAQs That People Normally Ask About A Property Title Transfer

Q1: What do you need to do for a property title transfer?

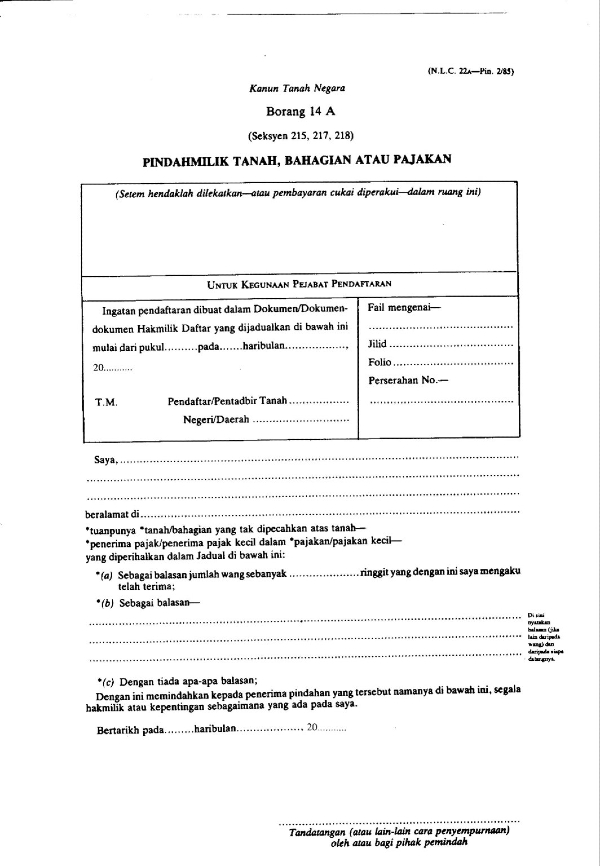

Your process will involve the review (either by an arbiter or judge) of Form 14A, or of the Deed of Assignment (DOA).

You will need to submit Form 14A of the National Land Code (Act 828) for the transfer of ownership of a property, as specified in Section 215, 217, and 218 of the Act:

- (1) The transfer under this Act of any alienated land shall be effected by an instrument in Form 14a.

- (1) The transfer under this Act of any undivided share in alienated land shall be effected by an instrument in Form 14a.

- (1) The transfer under this Act of any lease shall be effected by an instrument in Form 14a.

Now, for properties that have not yet been issued an individual title deed, the transfer of ownership is usually done through a document called the Deed of Assignment.

This contains the details of the property, the "history" of the property, as well as the agreement between both the assignee and the recipient of the rights (which is stated in writing and signed and testified).

If it is prepared by a lawyer, it will be witnessed by the lawyer concerned. However, only debt-free properties are assigned through such documents, and are not assigned to one which are owed to the bank as collateral for financing.

A property that is still vested (read: granted fully and unconditionally) in the bank cannot be assigned to ownership, unless the bank debt has been settled, and the bank has transferred ownership of the property through a document called the Deed of Receipt and Reassignment.

PropertyGuru Tip

The Deed of Receipt and Reassignment (DRR) is a legal document where the bank acknowledges that the mortgage has been fully repaid. It also recognises that the bank is forfeiting the property, the rights, and the interest on the original Sale and Purchase Agreement for the property, as everything is now returned to its current owner.

The most important document that needs to be in place for a property that does NOT yet have this title deed, is the original Sale and Purchase Agreement (the document received when the property was FIRST purchased from the developer).

Each time there is a sale to a new buyer and subsequent vesting (read: transfer of legal authority) to the bank as the financier, a new deed and debt relief deed will also be signed.

All these documents should be kept together so that the chain of transfer of rights is not "broken", and it will help to smoothen the process.

For such matters, a notification must be served on the developer. The developer will act as a "record keeper" of the latest ownership of the property.

The parties involved in the next transaction will be able to write to the developer and ask for important confirmation regarding the property, such as who the current owner is, and whether it is being vested in any bank as collateral for financing.

In conclusion, every real estate transfer transaction, whether using a transfer instrument or a deed, requires the preparation of documents and cannot just be a verbal agreement.

Q2: How do I perform a property title transfer after a death?

The procedure will be different for both the Muslims and non-Muslims.

For Non-Muslims who have passed away without a will, the next of kin will need to get a Letter of Administration (LA) and distribution order, so that the property can be transferred to beneficiaries, or proceed to be sold off to others.

According to Joyce Lau Yu Chai, Advocate & Solicitor, Joyce Lau & Partners, she said that the LA and distribution order is a must for the property owner’s next of kin to sell the said property.

She added that if the owner who has passed away has a will, the Grant of Probate (GP) has to be obtained instead, in order for the executor to do the property title transfer to the names of the beneficiaries in accordance with terms stated in the will.

The Grant of Probate acts as a permission issued by the High Court to the beneficiary of a will, empowering him/her to legally handle the owner’s property.

After the application has been done, the High Court will decide through a hearing, and the GP will be issued in order for the said property’s administration could be undertaken.

Meanwhile, the Muslims will be required to follow the procedures that have been set as per the Syariah High Court.

Under the Syariah law, the inheritance of a property will be based on the law of Faraid, a system which determines the share, limits, and direction of the inheritance of the property of deceased.

This procedure is done by acquiring a Faraid Certificate from the Syariah High Court, and the distribution of the assets will be carried out as per the Faraid Law, or general agreement.

The Syariah law also states that the inheritance of up to one-third of the value of property can be decided using what is known as wasiyyah, or Islamic will.

Q3: What is the procedure for property title transfer between spouses?

If you want to just transfer the title of a property you own to your wife or husband, you can do so without going through the hassle of stamp duty and Real Property Gains Tax (RPGT).

Lau clarified that the property title transfer can be by way of “love and affection” (pemberian secara kasih saying), which will occur without any monetary gain.

For this kind of transaction, which can also be for parents giving their property to their children, Form 14A can be signed in front of a Registrar/ Land Administrator for free, before proceeding with the next steps.

The transaction can be made without a lawyer for cash payment, while the bank will request it to be done by a lawyer if the transaction is via a bank loan

Q4: If spouses share ownership of a property, what is the procedure to split it when they get a divorce?

Lau explained that the entire procedure will be based on the individual divorce settlement terms.

Q5: How long does it take for a title transfer?

According to Lau, the duration for the process of a property title transfer would depend on the type of property.

If it is leasehold and encumbered, or if it is property under a master title and encumbered, it will take around six to seven months.

While if the property is freehold and holds no restrictions, it will take around three to four months for properties which are encumbered and three months for those not encumbered.

PropertyGuru Tip

The word ‘encumbered’ simply means a form of restriction on the property, such as a mortgage, which must be removed before ownership is free and clear.

Q6: Can one name be removed when there are two names as owners?

If the property is encumbered, you will either need to settle the loan first or have to refinance the property in order to perform a property title transfer, Lau explained.

If the said property is free from loan, then the transfer can be done anytime.

She added that of the other party is not responding to the requests for the transfer by buying over, then it is best to obtain a court order.

Q7: What if one of borrower/owner passes away, or is missing in action?

Keep in mind that if the loan is in the name of one party only (for instance, the husband) but the grant says that the owner is both the husband and wife, when the husband (as the loan payer) dies, then the home loan will be fully covered by the life insurance.

This applies for the takaful version as well (assuming that Mortgage Reducing Term Takaful [MRTT] was obtained), according to lawyer Salkukhairi Abd Sukor.

However, he said that if the home loan is under two names (both husband and wife) and both of them take MRTA/MRTT, if one party dies, only the loan portion of the deceased spouse will be covered by the insurance company.

In addition to that, the surviving spouse’s portion of the loan still has to be paid by the him/her.

In conclusion, although it is known fact that family is one of the most important things in life, you should also understand that it doesn’t mean it is not necessary for you to consult a lawyer when it comes to drawing up legal documents that involve more than one party.

On one hand, it will ensure that any legal headaches in the future are avoided, while also ensuring that the family isn’t broken up by any potential legal disputes.

Relevant Guides:

Disclaimer: The information is provided for general information only. PropertyGuru International (Malaysia) Sdn Bhd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.