Since the start of the year, I’ve noticed that the real estate market has somewhat quieted down a bit. A lot of people have asked me since, what my prediction of the market would be like.

My genuine answer is, “The market is plateauing at the moment, and… it is about time it did!”

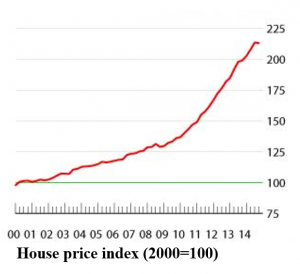

Now, I’m not a sceptic of the market, rather, all I am saying is that it is about time the market consolidated and people took time to really digest what has happened in the market in the past few years. We have experienced one of the most exciting times in recent years, where we saw prices in some areas doubled, if not tripled, in value. Perhaps, now is the time for us to take it all in and let the dust settle a little before the market starts to rally up again.

Many people are concerned when the market starts to slow down and many others are hoping the upward rally will continue. My personal feeling is that it shouldn’t. The property market isn’t like any of the other commodity markets, like the stock market for example, at least not in Malaysia.

There are many factors that can lead to the overheating of the real estate sector, and potentially leading to a meltdown. While I do believe we haven’t reached that level, we certainly have the potential of moving towards there.

I would like to share my personal points of view on why I say the market should definitely slow down, and I have summarized them into three main points as follows:

1) Are we working for money or is money working for us?

It is generally known that the best reason to invest into properties is mainly because of the ability for us to stretch our investment ringgit to the max.

Imagine this, with just RM100,000, most of us can qualify to take a loan up to ten times that amount, which is RM1,000,000! The leveraging factor is amazing for this class of investments. While we have experienced our loan to value ratios reduced tremendously to 70% since 2010, we can still buy two residential properties and take 90% loans before being capped.

The alternative is also to buy commercial properties for investments, as the banks are willing to loan up to 80% of the value, giving us a 1:5 ratio for the value of our money.

Now, of course we need to repay our loans, which means we need to allocate a certain amount of cash for the monthly instalments.

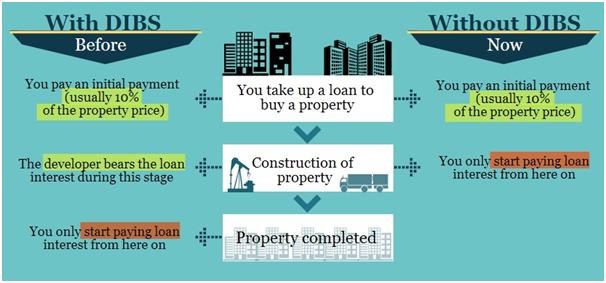

There have been many investors who have looked for smart ways of taking on more loans, while minimizing the repayment instalments as much as possible. Several ways in the past are such as the DIBS scheme (which has stopped since end of 2013), where the developer finances the instalment until the completion of the property.

The DIBS scheme was abolished in 2013 to encourage responsible lending. While it is a scheme in the past, I would like to use it as an example to share how this might be one of the property investment traps that exist in the market.

Assuming Mr. Tan bought Property A, which has the following characteristics.

Property Value = RM500K

Mr. Tan took a loan of 90% at 6% interest for a 30 year tenure.

Loan amount = RM450,000

Instalments borne by developer throughout the development period.

Instalments after property completed = RM2,698 per month.

Upon getting CCC, the DIB scheme stops, and Mr. Tan now has to pay the instalments in full. At this point, whether you are selling the property or renting it out, you should consider adding just a little bit or renovation to the unit to make it stand out from the rest.

Let us not forget, if you have bought it new, there are probably hundreds (if not thousands) of similar units going for sale and rent at the same time. However, putting this aside, if you were Mr. Tan, and you had an offer to purchase properties with little or no money down, and no financing required for at least three years, how many of such units would you buy?

Perhaps you are the prudent one to purchase only one or even none. During the past three years, I assure you there were quite a few people who bought more than just one of these types of properties.

Assuming Mr. Tan was a little bit more aggressive, and went on to buy three properties of the similar price, upon completion, he would need to bear an installment of RM8,094 per month. Within six months, he would have paid RM48,564, and in one year, RM97,128. Assuming even if Mr. Tan earned RM10,000 a month, paying RM8,094 monthly would be a burden to him, yes?

The simple term for this is over-leveraging. For many investors in this situation, what initially was the intention of making money work for you, turned out to be you working for money.

2) Are we investing or trading?

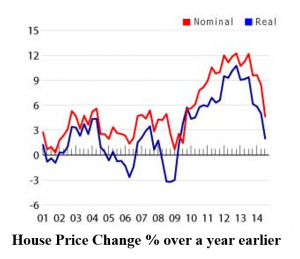

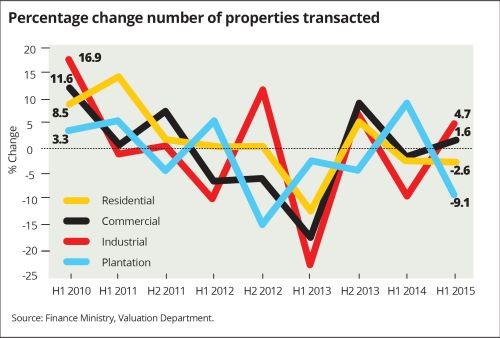

Now, you are probably asking, why would people like Mr. Tan invest so heavily into properties? Well, in the past five years since 2010, we have seen the property prices escalate due to a surge of demand in the market. Where is this surge coming from? Is there a sudden burst of the population or foreign migrants coming into our cities?

Yes, and no. While the initial boom was triggered by real demands from home buyers, it was the later years of 2012-2013 that we saw a swarm of investors coming into the market, hoping to invest and make some money out of the real estate market. Places like Cyberjaya and Iskandar in Johor saw property prices rise to new heights, as well as development properties snapped up overnight.

What were the intentions of some of these investors? While I am only speculating, I believe there was a mix. Some of these investors were in it for the potential returns from renting, however, my opinion is, most were interested in the potential capital gains, in other words, to buy and sell quickly to make a quick buck.

So, why would people like Mr. Tan unexpectedly buy so many properties? Probably to sell one or two off quickly for capital gains, since he noticed that the property market was on an up cycle.

If Mr. Tan were to expect a 30% gain, he would expect to sell his property that he bought at RM500K, at about RM650K within three years. Now here’s the thing, in 2013, our government reinstated the real property gain tax (RPGT) to 30%. If Mr. Tan were to sell his property now, he would make almost nothing from it, forcing him to reconsider holding it a little bit longer to make a fair amount of gain from the investment.

Now, remember, Mr. Tan has to pay RM8,094 per month for three of his properties, and if he is not ready to put in more money to renovate the place to rent, or ready to hold it for a longer term, he might just get caught in a fix.

I guess this is where I draw the line between investing and trading. To me, there are much deeper fundamentals in real estate investment that a person must understand, in order to get the best value out of it. If a person were to ask me how I evaluate the property to determine its value, my answer would be, I do not.

There is little or no true value in the property itself, rather, it is how the property serves the market, the population, and the needs of the target market in the location where it is situated at the right timing that brings true value. All these factors do take time to study and understand before one makes a solid judgement of whether to invest or not in the properties in the said area. I call this Value Investing.

I felt that in the past years, a lot of investors have missed this point completely, and have rushed into deals without truly understanding the value. When this happens in a large scale, it creates a mob effect, hence, surging the market forward without any true fundamentals.

3) Real estate is like wine

This comes to my final part. Hearing all that I have said, perhaps one might be asking now, does that mean people like Mr. Tan are going to lose their money? The answer is, “Maybe”.

While the situation may sound morbid, the good news is that the property market, especially in Malaysia, is rather forgiving. If Mr. Tan were to be able to hold through, the market may eventually settle and start to pick up again. I would like to defer my view a little from those who are skeptical about the market. While I do believe that we are going through a period of adjustments in the market, and we are seeing and expecting the market to be slower in months to come, I am rather confident that the market will start to pick itself up again.

There is a short term of oversupply in the market, and while this may be present, I do believe, in the longer term, there is still real demand. Holding the local and global economy factors constant, the need for a place to stay will continue to be there.

On a longer term prospective, I do believe that property is like wine. Unlike any other types of investments, there is true economic value in real estate, and given time for it to mature, real estate will eventually serve its rightful place in fulfilling the needs of the population.

Thus, for the impatient few, perhaps it is time to reset your outlook on the properties you have bought and look on a broader horizon to see how to bring the best value out of them.

A market slowdown isn’t necessarily a bad thing, perhaps, similar to wine, this is just an ageing process to boost up the value of real estate.

Who is Michael Tan?

I am many things, an entrepreneur, an investor, a speaker, and a coach. I am a person who has a thirst of life, and have experienced many failures and successes to make me who I am today. Most importantly, it was the great people I surrounded myself with, and whom have served me, that has made me bigger than who I am.

In return, I now dedicate my life’s purpose to helping as many people as I can to achieve their freedom through properties and beyond, in my company, Freemen. We run courses to educate people and coach them to living life beyond just a normal 9 to 5. I am proud to say that we have the largest life-changing network through property investment in Asia, being Number 1 in Malaysia, Thailand and Hong Kong.

Our goal is to empower people to live life to the fullest and make a stand for humanity. If you are ready to step up your game, do drop by for a coffee.

Upcoming Event with Michael Tan

If you’re ready to get started in property investments, or you want to massively grow your property portfolio in 2016, come and meet up with Michael along with other Property Experts including Elizabeth Siew (on property law), and Gary Chua (on banking and financing) at the 2-Day Intensive Mastering Your Wealth in 2016 event.

More info at www.masteringyourwealth.asia

Michael will be elaborating more on the property market for the year. He’ll load you up with lots of interesting facts and figures. And more importantly, he will share with you how to Master the 4 Millionaire Blueprints to be a successful investor – anytime, anywhere!

Secure your limited VIP Gold Pass Package that comes with Millionaire Tools and Resources, and even a chance to have a VIP Lunch with the Speakers and other successful property millionaires.

Register NOW at http://www.masteringyourwealth.asia/