Putrajaya is scrutinising the Housing Ministry’s proposal to permit property developers to lend to home buyers who are unable to acquire mortgages from commercial banks. This is due to concerns that it may trigger a financial crisis like the one that happened in the US, given that Malaysia has one of the largest household debts in Asia.

Last week, the cabinet instructed Housing Minister Noh Omar to review and fine-tune the proposed initiative announced on 8 September that will grant money-lending licenses to home builders.

According to Noh, the planned move would benefit both property developers and home buyers, as customers will have the option to borrow from home builders, but at higher interest rates of up to 18 percent.

However, the decision was lambasted by bankers, economists and other experts, who warned that allowing developers to lend would exacerbate the country’s financial problems, including the high household debt. As a percentage of gross domestic product (GDP), it hovers at about 89 percent, representing one of the highest in Asia.

“More unregulated lenders and subprime borrowers will compound the risk of a debt crisis,” said CIMB Group’s Chairman Nazir Razak in a recent Instagram post. He also added that it is a “dangerous idea”.

This is because subprime lending, or the practice of giving loans to people with poor credit history at heftier interest rates, caused the 2008 Global Financial Crisis.

According to Fitch, “the scheme is likely to encourage unregulated lending to households with weak financial profiles, and could undermine the strength of the financial system if not implemented prudently.” It could also heighten the risks linked with rising household debts.

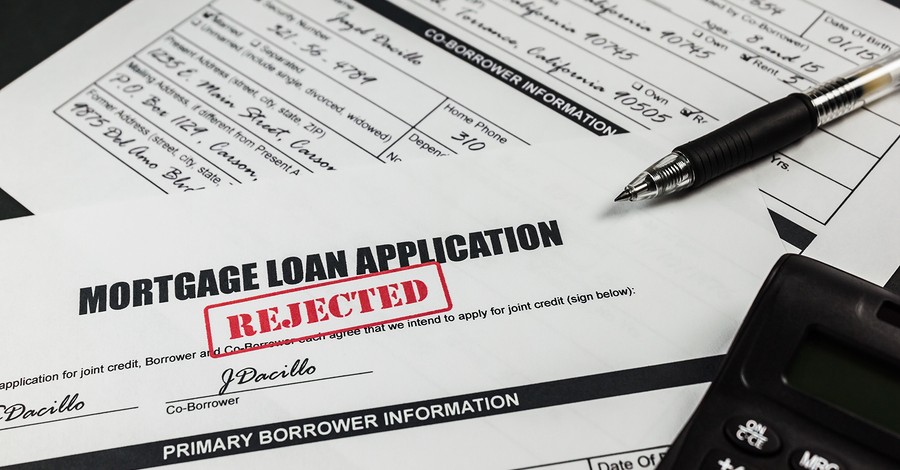

In addition, a large number of potential home buyers would have no choice but to get loans from developers, given that mortgage rejection rates by banks is near record high.

Statistics from Bank Negara Malaysia revealed that lenders’ rejection rate for mortgage loan applications for residential properties reached an all-time high of 61.7 percent in January 2016. In July, the rejection rate was slightly lower at 57.3 percent.

The proposal also comes at a time when the country is reeling from sluggish oil prices. In fact, Malaysia’s economic growth moderated for the fifth consecutive quarter in June.

Nevertheless, it may help the country’s property market, as it may address financing problems that are largely blamed for the growing number of unsold houses.

Based on data released on Wednesday by the Real Estate and Housing Developers Association (REHDA, home builders sold only 39 percent of the units launched in 1H 2016 compared to 52 percent in the second half of 2015.

“The problem is (buyers) don’t have the capacity to find the margin of financing,” said REHDA President Fateh Iskandar Mohamed Mansor.

He noted that housing loans granted by local banks usually cover 75 to 80 percent of the purchase price, and home builders could finance the remainder thanks to proposed money lending licence.

So far, leading property player Mah Sing Group is looking into the feasibility of offering loans, but there are no requests as yet from its clients, said its Group Managing Director Leong Hoy Kum in an emailed statement.

Image sourced from The Rakyat Post

Diane Foo Eu Lynn, Senior Content Specialist at PropertyGuru, edited this story. To contact her about this or other stories email diane@propertyguru.com.my