Knight Frank, the independent global property consultancy, launches Global Cities: The 2017 Report, examining the market performance of 31 global cities across the world in light of three major trends shaping the times:

- Negative interest rates have reduced investors’ expectations on what constitutes an acceptable return, which is drawing capital towards real estate.

- Despite the volatile economic environment, the avalanche of technological innovation continues to drive demand for property on a global scale.

- Fast-growing cities are centre stage in the digital and creative revolutions, and in many of those at the forefront, supply is not keeping pace with demand for both commercial and residential real estate.

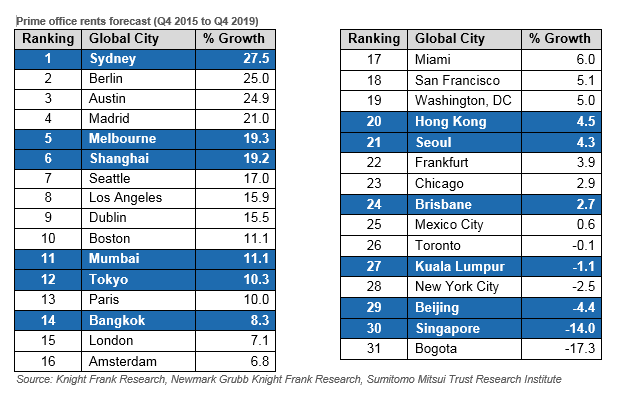

Prime office rental forecasts

Of the global cities analysed, 12 are in Asia-Pacific – a region continuing to grow in economic importance globally. The prime office rents forecast from Q4 2015 to Q4 2019, however, show a huge range of future performance prospects:

- Asia-Pacific markets show a huge range of growth prospects, with Sydney projected to see the strongest growth of 27.5% and Singapore the weakest with a forecast rental decline of 14.0%.

- Kuala Lumpur and Beijing are also expected to experience negative growth at -1.1% and -4.4% respectively.

- Shanghai (19.2%), the only Chinese city on the top 10 chart, sits in the sixth position, a notch down from Melbourne (19.3%).

Nicholas Holt, Head of Research, Asia Pacific, Knight Frank Asia Pacific, says, “Our prime office rental forecasts stretching to the end of 2019 offer an insight into how demand drivers will interact with supply dynamics over the coming cycle.

“Sydney, along with Melbourne, continues to see diversified demand drivers, as the Australian economy continues to show resilience despite the slowdown in demand for commodities; while Shanghai has boomed on the back of strong growth from technology-related companies.

“In many ways, the weakest projections come down to supply, with Kuala Lumpur, Beijing and Singapore markets all seeing a significant amount of new supply come to the market that new demand is being challenged to absorb.”

According to Knight Frank Malaysia executive director of Corporate Services Teh Young Khean, the challenging times faced by the oil & gas sector today has led many of them contracting and subletting office space. However, we are seeing a bright spot in Multimedia Super Corridor (MSC) designated buildings and Cyber Centres which will continue to grow well with companies in e-Commerce, tech, IT and shared services sectors favouring these locations.

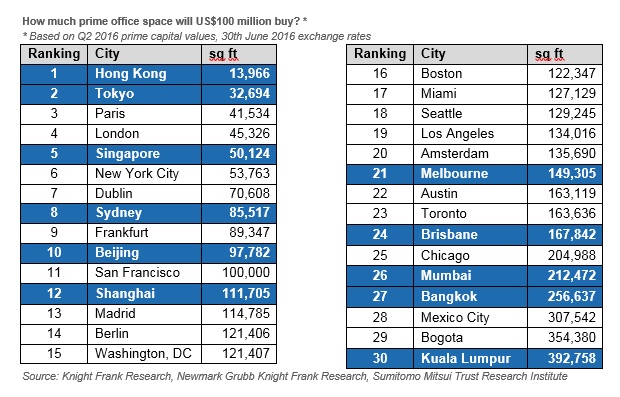

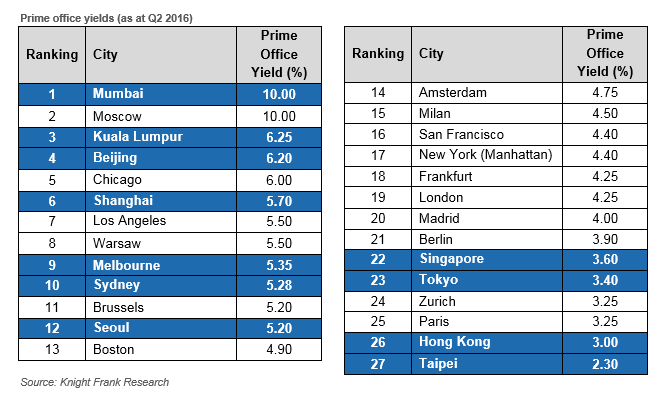

Capital values

As part of the 2017 Global Cities report, Knight Frank has examined how much prime office space investors can acquire for US$100 million in the world’s leading cities.

Across the 30 global cities analysed, Kuala Lumpur offers investors the best value, where a prime office building of over 390,000 sq ft could be purchased for US$100 million.

Three of the five costliest cities globally are in Asia-Pacific, with Hong Kong boasting the highest capital values for prime central office space, followed by Tokyo in second place and Singapore in fifth.

Sarkunan Subramaniam, Managing Director, Knight Frank Malaysia, says, “Kuala Lumpur represents the best value for money across the world, offering the highest yields and the least volatility in the market across the Asia-Pacific region. Coupled with the step-up on transport infrastructure development which increases the mobility and connectivity throughout Greater Kuala Lumpur, this transformation gives Kuala Lumpur the edge and represents the best value proposition for any multi-national corporations or investors in the Asia-Pacific region.”

James Buckley, Executive Director, Capital Markets, Knight Frank Malaysia, adds, “With Malaysian real estate offering good value on a regional basis, a number of foreign investors continue to show interests in the market.

“Notably, some major Japanese groups searching for diversification away from their domestic market and benefitting from a low cost of debt environment have been actively looking at stabilised income-producing assets in Kuala Lumpur.

“Additionally, Chinese investors are continuing to look at development opportunities, while US private equity groups have also been looking for value in the Kuala Lumpur market.

“Looking forward, the attractive yields on offer, the relative weakness of the currency and the long-term growth prospects will continue to ensure foreign interest in Malaysian real estate.”

Datuk Zainal Amanshah, Chief Executive Officer, InvestKL Malaysia, echoes that Kuala Lumpur today has several business hubs for investors to choose from. Global multinationals are looking at the city’s fluid business ecosystem and cost-competitive factor as favorable advantages compared to other major cities in the region. Kuala Lumpur’s competitive real estate rates, cost-effective talent and generally lower operations cost are main criteria considered.

As of 2015, InvestKL has attracted 51 MNCs with cumulative approved / committed investments of US$1.4bn (RM5.9bn) and created more than 7,000 high-skilled job opportunities.

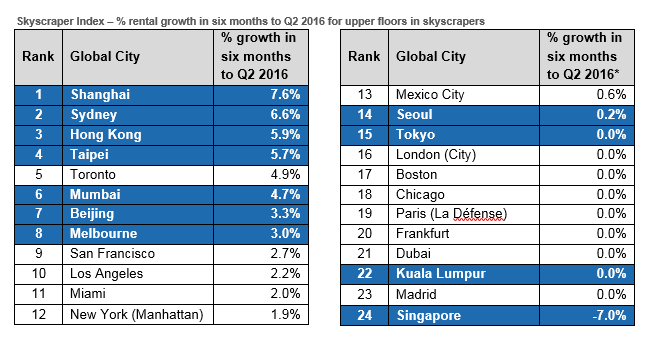

Skyscraper Index

The Skyscraper Index examines the rental performance of commercial buildings over 30 storeys.

Looking at the performance of skyscrapers in the six months to Q2 2016:

- Asia-Pacific cities experienced the highest rental growth across the 24 global cities tracked.

- Skyscrapers in Shanghai recorded the strongest rental growth in the first half of 2016, at 7.6%, followed by Sydney (6.5%), Hong Kong (5.9%) and Taipei (5.7%).

- Singapore sits at the bottom of the chart with a decline of 7% attributed to significant new supply and a slowdown in the local economy.

- Hong Kong remains the most expensive city to rent a prime office space, at US$278.50 per sq ft. This is significantly higher the runner-up New York (Manhattan) where rents have reached US$158 per sq ft.

Holt comments, “At the mid-point of 2016, the global skyscraper story really has an Asia-Pacific flavour, with the top four performing cities in terms of rental growth situated in this region.

“Home to the largest cluster of super tall buildings in mainland China and the tallest skyscraper in the region (Shanghai Tower) – Shanghai’s skyscrapers saw the strongest rental growth rates over the first six months of the year. Tight vacancy rates in the city’s Lujiazui district are likely to further encourage rental growth over the coming months.

“In terms of actual rental levels, Hong Kong’s skyscrapers remain the highest in the world, and with demand likely to outstrip supply for the foreseeable future in the city’s central business district Central, we expect the city to retain its top position in the Index.”

Click here to download the full report