After a 3-year steady but gradual decline in property prices, will 2019 see the property sector bottoming out – sparking hopes for a long-awaited recovery which market players are hoping for?

Despite improving consumer sentiment and proactive government policies announced in the Budget 2019, 2019 is likely to see a continued price downtrend for at least the first half of the year. With the inflation stabilising and various affordable housing schemes coming into play, first time home buyers may soon be able to afford a property.

Between October 2017 and October 2018, the Malaysia Consumer Price Index (CPI) increased by 0.6%. As compared to the increment in CPI of 4.3% between September 2016 and September 2017, the comparatively slight change between 2017 and 2018 is further indication that inflation is indeed stabilising.

Another indicative factor of an improving economy is the low unemployment rate of 3.3% in Sept 2018, which shows a decline of 0.1% as compared to Sept 2017 (3.4%).

PropertyGuru Market Index 2018

The PropertyGuru Market Index (an analysis of over 250,000 property listings aggregated and indexed) shows that asking prices of homes in Malaysia continue to drop nationwide as well as the key property epicentres of Kuala Lumpur, Selangor, Johor and Penang, signifying a price correction.

The downward trend of asking prices is reflected in both quarterly and annual price movements despite improved consumer sentiment of 42% and 53% of Malaysians respectively, wishing to buy a home by the end of 2018.

In the third quarter of 2018, the PropertyGuru Market Index showed that asking prices by real estate developers, property agents and individual owners nationwide had dipped by 2% from the preceding quarter. Year-on-year, prices show a 2.3% drop.

Kuala Lumpur

The Kuala Lumpur trend line shows slow but steady downward movement, with asking prices declining by 1.4% year-on-year, from Q3 2017 to Q3 2018. As compared to Selangor and Penang, the comparatively slower decline in Kuala Lumpur is an indication that property prices within the city centre are close to bottoming out.

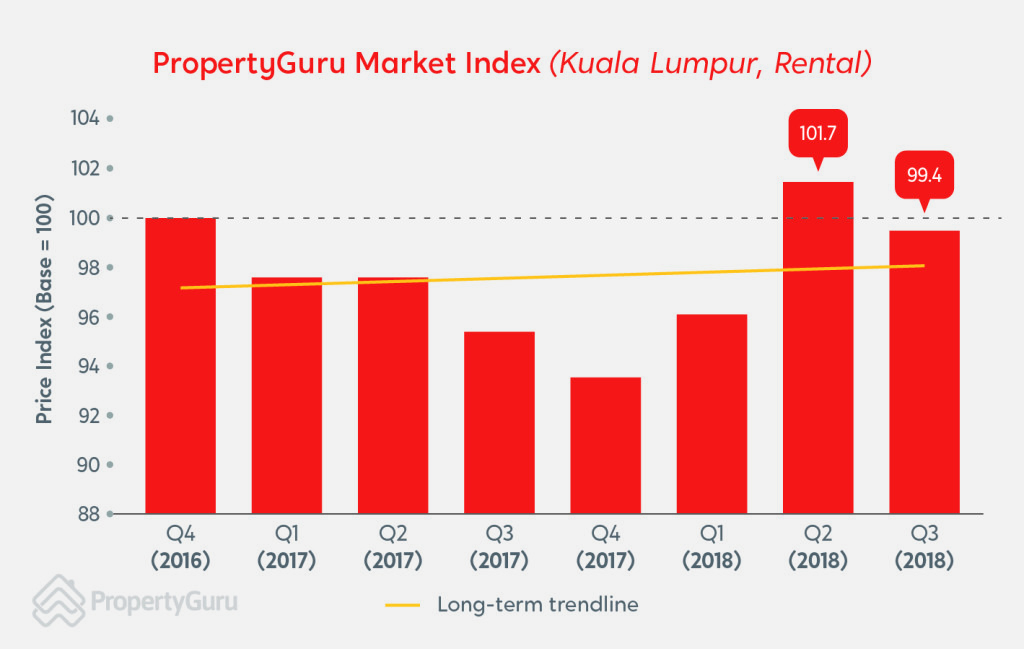

According to the PropertyGuru Rental Price Index, the rental prices for residential properties in Kuala Lumpur is also on a declining trend, with a reduction of 2.2% between Q2 2018 and Q3 2018.

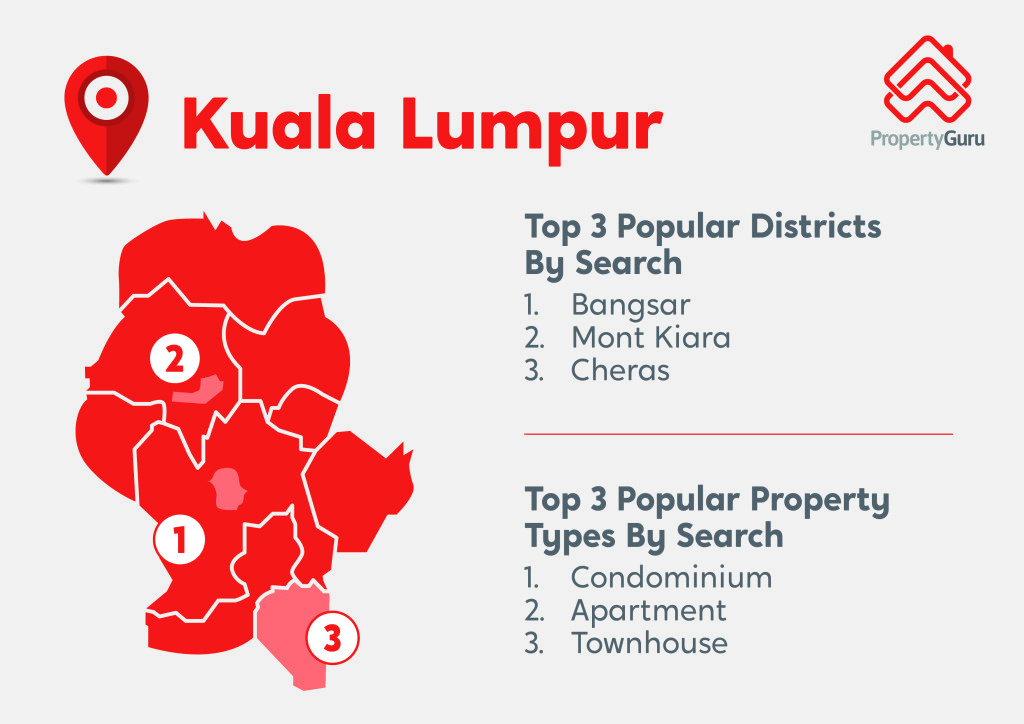

While there has been a dip in asking prices, the demand for property in Kuala Lumpur is still strong with the most popular and highly searched areas being Bangsar, Mont Kiara and Cheras. Property types that are most searched in these 3 areas are condominiums, followed by apartments and townhouses. The reason for high-rises being the most preferred property type in Kuala Lumpur may be due to their more affordable entry price points.

Selangor

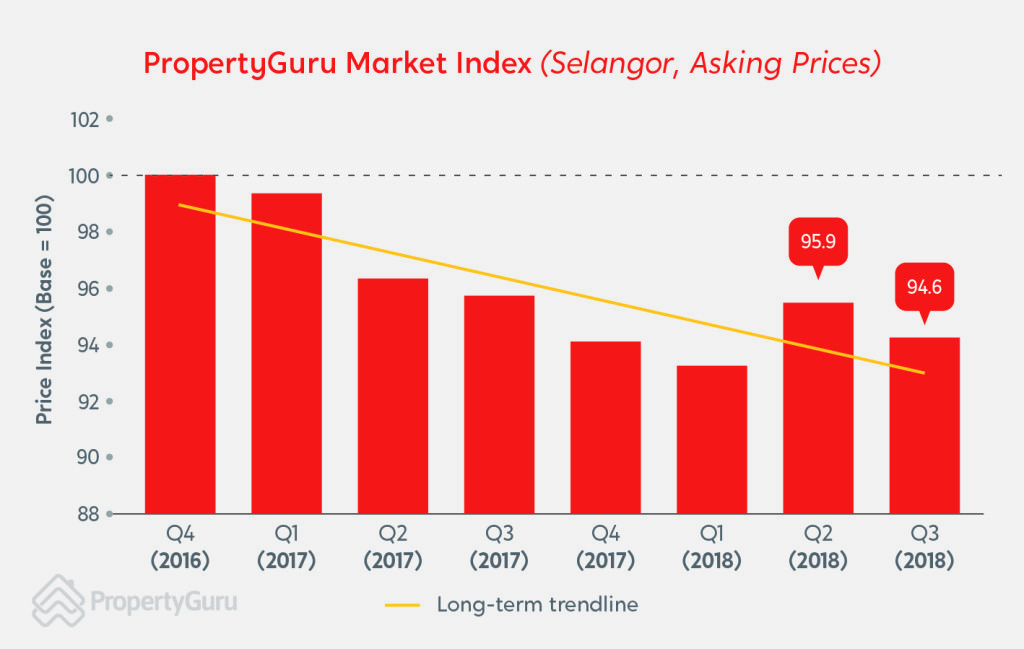

Selangor has seen one of the sharpest decline in prices as compared to Johor, Kuala Lumpur, and Penang. The Selangor market index saw a decline of 0.8% in Q1 2018, followed by an incline of 2.8% in Q2 2018. The index then dropped again by 1.3% in Q3 2018.

The rental prices of residential properties in Selangor has also begun to decline since the beginning of 2018. While it enjoyed steady and even increasing rental rates from Q4 2016 to Q4 2017, it began to decline by 4.2% in Q1 2018, 0.7% in Q2 2018 and 2.2% in Q3 2018.

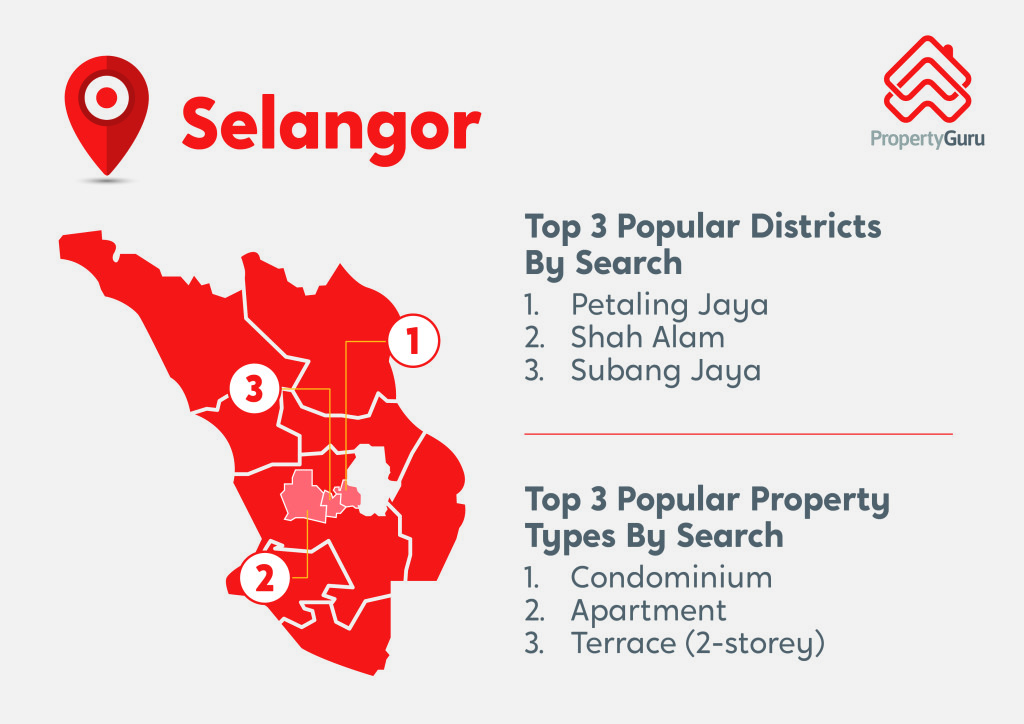

The demand for properties in Selangor continues to be high, with properties in Petaling Jaya, Shah Alam, and Subang Jaya topping the list in this order. Properties that are most searched for in these areas are condominiums, followed by apartments, and terrace houses.

Penang

The prices for Penang properties have been on a steady decline. While the index saw an improvement of 0.6% in Q1 and Q2 of 2018, they declined again by 1.5% in Q3 of 2018.

As opposed to Kuala Lumpur, Selangor, and Johor which saw a dip in their rental prices, Penang has had a very stable price trend, which saw an appreciation of 1.7% in both Q2 2018 and Q3 2018.

The most popular residential areas within Penang are Georgetown, Bayan Lepas, and Tanjung Tokong, with the common factors of all four locations being their centrality to either the city centre or the Penang International Airport. Apartments and condominiums are the most desired types of residential properties in this area, followed by townhouses.

Johor

As of Q3 2018, Johor has seen a decline in its prices for the second time in 2018. While there was a dip of 0.8% between Q4 2017 and Q1 2018, the prices for properties in Johor increased by 2.1% again between Q1 2018 and Q2 2018. This was then followed by stronger dip of 3.1% in Q3 2018, Johor’s strongest decline yet since Q4 2016.

As compared to Kuala Lumpur, Selangor, and Penang which has been facing a downtrend since 2016, Johor was the only state that was experiencing an uptrend. The fact that its prices is beginning to dip shows that the property prices in Johor may finally be correcting.

Similar to its asking prices which saw a decline, the rental prices in Johor have also begun to see a dip. For the first time since Q4 2016, the asking rental prices for residential properties in Johor dropped by 3.5% between Q2 2018 and Q3 2018.

The most popular locations within Johor that property buyers are looking at are Johor Bahru, Nusajaya, and Bukit Indah. And unlike the other states where property buyers were most interested in high rises, in Johor the demand is highest for landed properties, especially terrace houses.

Here’s how you can take opportunity of the market condition

Given that budgets are tight and there is plenty of supply, many may choose to look around for the first six months before making a purchase decision later in the year.

Others may adopt a wait-and-see approach, hoping to benefit from the various home affordability schemes by the government and even the annual PropertyGuru GuruDeals during which Malaysians can get the steepest discount deals exclusively and only for a limited time.

The initial optimism expressed post GE14 is beginning to wear off as buyers are adopting a more cautious approach. Property buyers should expect the property market downtrend to continue in the first half of 2019, with a chance of market recovery post the third or fourth quarter of 2019.

A continued but stable price downtrend is not necessarily a negative development as shown over the past 2-3 years. Present market conditions have compelled developers and private sellers to be more competitive in terms of quality, design ideas, ownership packages as well as pricing.

It’s a healthy situation – there is plenty of supply for both purchase and rental for Malaysians to choose from and the sluggish conditions are also encouraging greater innovation and ideas to come to the fore, especially with regards to build and design, spatial use, technology and more.

We still see many positives and we hope the prevailing issue of unaffordability and lack of financing can be overcome. In fact, this is the best time for Malaysians to consider owning their own homes. Here at PropertyGuru, we take home ownership very seriously. Case in point, the PropertyGuru “Own Your Home” programme was recently launched to empower Malaysians to become homeowners.

A key component is the PropertyGuru Mortgage Pre-Qualifier. It is the first and only product in Southeast Asia that enables Malaysians to find out for sure how much of a bank loan they will be approved for, accurate by 99.5%. This tremendously improves chances of securing a home loan as Malaysians would be able to make more confident property decisions.

Here Is Our GuruView For The Year Of 2019:

1) Increased Public Transport Ridership to Boost Demand for Transit-oriented Development (TOD) Properties

With the various incentives offered to boost public transport ridership under the Budget 2019, there is expected to be a strong upswing in demand for properties strategically located or directly connected to the MRT and LRT lines.

However, the impact may be felt more in rental demand as most of those using public transport are typically younger, from the working class, or middle-income Malaysians who may not be able to afford a home due to the gap between income levels and property prices.

Properties with direct access to public transport will continue to see strong demand and though emerging supply may have a dampening effect, rental rates for properties are likely to hold.

Beyond location, there are other factors that impact demand for a particular property such as, “Is it maintained well? Is it a new or old development? What facilities are provided? All factors must be considered, which is why there are always exceptions to the rule with some still seeing price appreciation while others may see price decline that exceeds the benchmark, despite the general downtrend for property price.

2) Smaller Units with Bigger Lifestyle Possibilities

Given unaffordability issues and scarcity of space in the city centre and key urban areas, developers will continue to build smaller, high-rise units – 450 to 840 square feet, which offer flexible spatial layouts to cater for varying demographic segments (single adults, young couples, 2+1 families, newly-weds, senior citizens or empty-nesters, etc.) These units will offer space-saving furniture to allow for greater space utility.

Dual key units are likely to be popular to those who wish to work and live at the same place. These smaller sized units will be built closer to public transportation and will come with more facilities. The latter will be a key determining factor for developers to win over buyers.

Buyers are accepting smaller homes as part of the reality of urban living. We have seen this trend since 2016. But they will not compromise on lifestyle. Hence, facilities and retail experiences, as well as seamless connectivity will be key determinants in winning over home buyers, especially Gen-Y and millennial.

3) Buyers Market but High Prices Remain a Challenge for Most

Despite the many positive initiatives announced for Budget 2019, the case of absolute high price of homes when compared to median income of most Malaysians is expected to remain the biggest stumbling block to home ownership, followed by lack of financing visibility.

The truth is home unaffordability is a difficult problem to resolve. Recent initiatives to aggressively manipulate market forces by bringing down home prices will lead to dissatisfaction among existing home owners, as they would potentially lose out on the equity and wealth they’ve built over the years.

A smarter move would be to look into the average annual capital appreciation of homes. This would be more sustainable in the long-term to ensure that prices stabilise over time for wealth preservation potential, while ensuring that aspiring homeowners can still afford to come onboard.

While pent-up demand for homes remains strong and is expected to continue increasing in 2019, the growing desire to own a home may not necessarily translate into completed transactions and upward price movements yet due to the various market dampening factors.

To keep up to date with the Malaysian property market, visit the PropertyGuru Market Index