Property and Finance experts gathered at the Property Outlook 2017 in Feb and March to share their findings of the Malaysian economic and property outlook with investors. The two-day event aimed to provide insights to the implications of the recent policies and the challenges faced by Homebuyers and Investors.

The depreciating Ringgit has caused the cost of living to rise higher, and the recent retrenchments in Malaysia has stirred anxiety amongst Malaysians as they worry that their income might not last them long.

So, to help participants get a better understanding of the Outlook, the speakers showed them some graphs and charts which reveal shocking data.

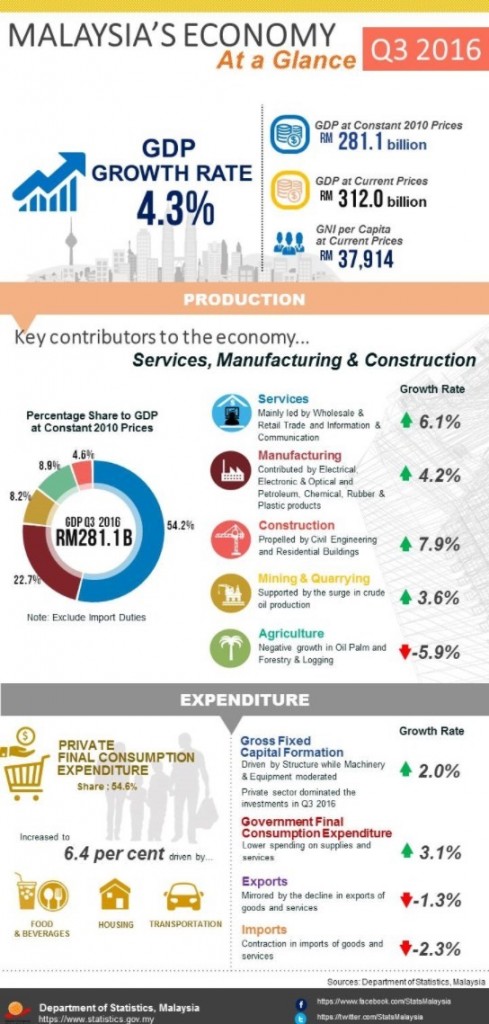

2016 Overview

Fundamentally, you could say that the property industry runs alongside the economy of the country. Domestic consumption rose, driven by spending in areas that include F&B, transportation and communication. Government consumption also grew (according to year-on-year basis) – with expenditure owing to infrastructure.

Net exports saw mixed results – slower demand from China and reduced exports from the US but the weakening ringgit enticing and increasing Malaysian exports even further. The weak ringgit also opened opportunities for foreign investment.

Other than the global rout in oil prices that has led to a significant number of layoffs in the oil and gas sector, the weakening business sentiment and slowdown in the overall trading is also expected to be more apparent, but in the short term.

Looking positive was the growth rate of retail sales which remained buoyant despite softer consumer spending and the rising costs of living. According to the report, strong support was seen from tourists in retail spending from shopping. The weakening ringgit is expected to encourage tourists’ spending.

2017 Outlook

In the Year of the Rooster, the country’s economic growth is expected to be slower due to the challenging global economic and financial landscape. Domestic demand is said to be the key driver of growth, sustained primarily by economic activity from the private sector. Due to the well diversified nature of our country’s exports, positive growth is projected into the year. However, inflation is expected to remain flat although pressured by increase of several price-administered items and the weak ringgit exchange rate.

The impact of these cost factors on inflation is expected to be mitigated by continued low global energy prices, generally subdued global inflation and more moderate domestic demand. Supportive fiscal and monetary policies are also expected to help steady the ship for economic growth. GST will strengthen the government’s revenue source to accommodate its fiscal measures.

With the overall weakening ringgit, low crude oil prices coupled with worldwide geo-political issues will continue to plague the economy in 2017. No doubt, the year will be a challenging one, but Malaysia’s economy is anticipated to remain stable with GDP growth estimated at 4.2%.

Real estate market outlook in Malaysia

As uncertainties and concerns over the large market supply remains unabated, loan growth is expected to slow further as the weak credit cycle continues.

Apart from the stringent loan requirements from financial institutions that are said to have caused the drop in the number of property transactions, the increasing cost of living and economic uncertainties have led to an upswing in worries about job security, resulting in more cautious consumer spending. These and more will have led the market to consist of more genuine purchasers with speculative sentiments not as strong as during the boom period.

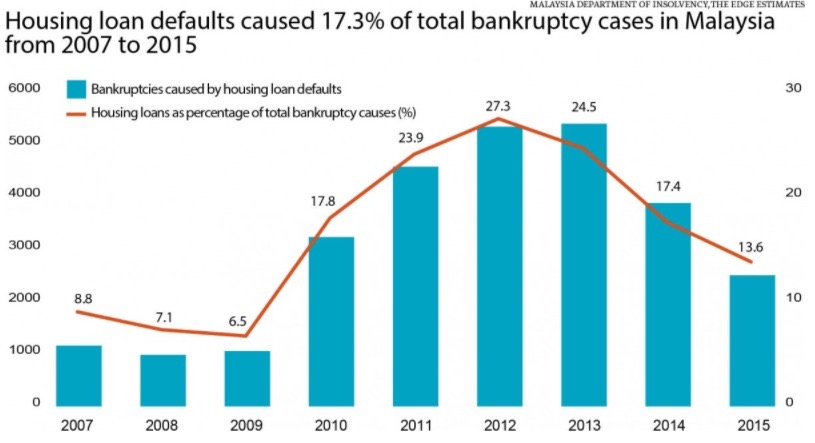

Moreover, those who had bought easily into properties worth over RM500,000 can’t keep up with the instalments thus causing the rise of housing loan defaults.

The rise in housing loan defaults could well be caused by people taking multiple loans for speculative activities that drove home prices above the RM165,060 level (three times the median household annual income in 2014) defined as affordable for most Malaysians and made cooling measures necessary.

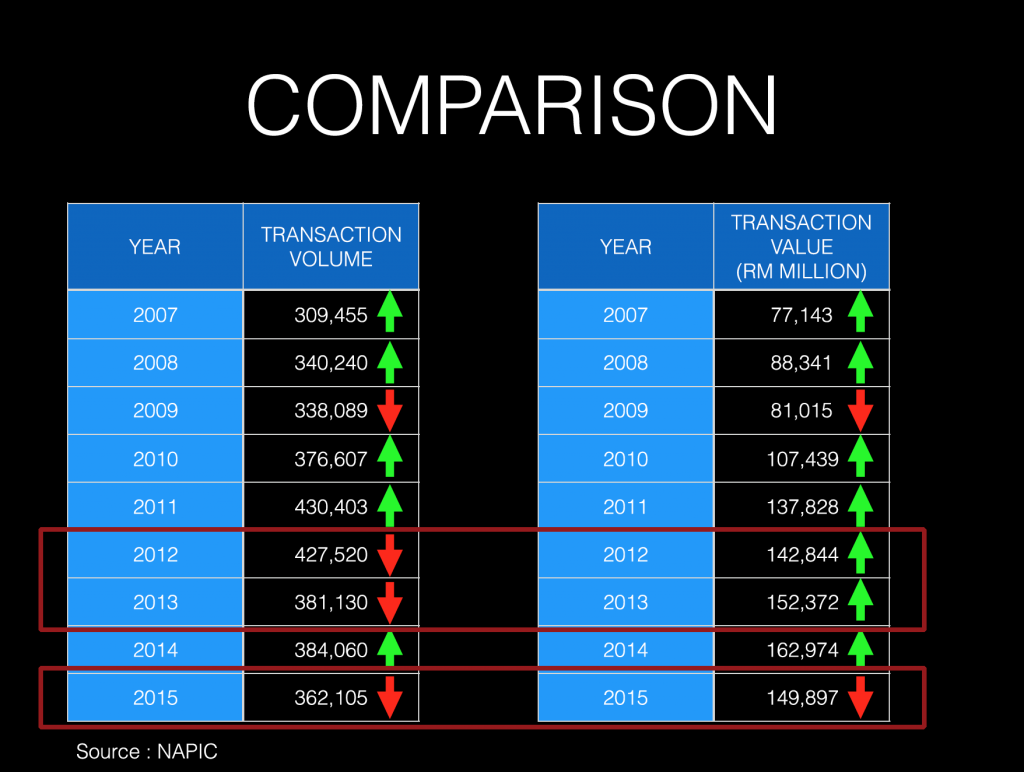

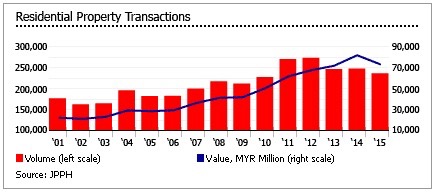

Moreover, statistics from NAPIC showed a decline in both property transactions and property value since 2015. This basically means that despite the property segment showing a growth, it is a minimal growth.

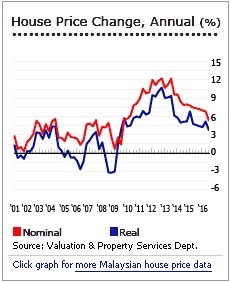

House prices in Malaysia have slowed. In Q3 2016, Malaysia’s national house price index rose by 5.36% y-o-y (3.81% inflation-adjusted), slightly lower than the 7.35% y-o-y (4.61% inflation-adjusted) price increase during the same period last year. This was the lowest increase since Q3 2009, based on figures from the Valuation and Property Services Department (JPPH).

The national average house price was MYR 334,736 (US$ 75,390.82) in Q3 2016.

Declining residential property transactions

In Q3 2016, the total number of residential property transactions fell by 13.91% to 49,640 units, or 11.96% by value, from a year earlier, according to the Valuation and Property Services Department (JPPH). Residential transactions accounted for 64.9% of all property transactions in Q3 2016.

In terms of value, residential property transactions dropped by 10.47% in 2015, following strong increases of 13.88% in 2014, and 6.34% in 2013.

As such, supply has remained resilient with greater activity in larger cities. The proposal to boost public servants’ housing loan eligibility proposed by the government, may stimulate some residential sales, apart from other plans to increase the number of units of low and medium cost, affordable housing. No doubt residential development will continue to be active beyond the KL fringe, especially supported by the rapid infrastructure development.

Conclusion

Looking at the real estate outlook in the Klang Valley for 2017 (refer boons and banes), key drivers to a positive year are expected to come from infrastructure – HSR, MRT and LRT additional lines and stations, new highways and expressways. While Johor and Seremban are expected to gain from the “spillover” effected from new infrastructure, residential hotspots to take note of include – Selangor Vision City, Nilai/Pajam, Semenyih/Kajang, Putrajaya/Cyberjaya, Rawang/Ijok/Kuang, Sungai Buloh and Kuala Selangor.

Key drivers that will push these areas are scarcity of land in the city centre, high land costs in the city as well as the improved connectivity in view of new infrastructure.

In his message at the launch of the 2016/2017 report, CBRE / WTW managing director Foo Gee Jen shared that on-ground consensus among practitioners throughout all its branches across Malaysia is that market conditions have become much more challenging in 2016 and that 2017 will not get any better.

Transaction activity is down in many urban centres, especially in the residential sector, which Foo said is a common barometer to gauge the overall property market. However, although figures in CBRE /WTW’s outlook report are discouraging, there is still a glimmer of hope for the year to correct itself once the mass rapid transportation system in Kuala Lumpur and other similar transport systems are up and running.

Bottomline

Foo’s view on the whole: “Another flattish period pulled down by mostly low commodity prices, continued slow economic growth in most major countries, especially with political uncertainties like Brexit, Trump’s presidency and other referendums in Europe.”

His advice: “Reduce portfolios of non-strategic assets to reduce loan gearing and be aware of liquidity needs if and when credit tightens. Investors and developers should focus on taking calculated risks where markets are strong, pursue developments in strong, supply-constrained markets and bid on strategic long-hold assets that are most likely able to withstand a downturn.”

Information and charts/graphs were retrieved from the CBRE / WTW 2017 Malaysia Real Estate Market Outlook. Follow our column next week on interior design, followed by office space in KL and market direction across various regions in Malaysia.

BOON

- Property investment will remain one of the safest forms of investment.

- The demand for affordable housing is likely to become acute.

- Genuine demand will lead the market.

- The market is expected to cool down with prices becoming more negotiable.

- Areas with good transportation connectivity (near MRT I & II, HSR, highways) will continue to be hotspots.

- Demographic forces will continue to drive underlying demand for residential properties.

BANE

- On-going concerns on the overall weak ringgit, low crude oil prices and worldwide geo-political issues will continue to plague the economy.

- Challenging year for developers.

- More savvy home buyers.

Advice:

Due to the changes in the current property markets, home buyers and investors need to be smarter and wiser. They need to be more aware of what kind of properties is worth buying into, and they must plan their strategies well.

At Property Stratagems, FREEMEN has gathered all the Property and Finance Experts to share strategies that will help both homebuyers and investors to find good properties, and assist them in planning a more profitable and prudent entry and exit strategies.

More info at www.propertystratagems.com